MetalMiner welcomes guest contributor Suriya Anjumohan, a lead analyst at Beroe Inc., which specializes in tracking various steel markets and related alloys. Beroe is the premier global provider of customized procurement services specializing in sourcing, supply chain visibility, financial risk analysis and environmental impact to Fortune 500 organizations. With nearly 400 dedicated procurement specialists in 38 domains, across 9 industries, Beroe proactively invests in knowledge assets to build valuable, real-time procurement insight.

<link http: agmetalminer.com monthly-report-metal-price-index-trends-oct-2014 _blank external-link-new-window external link in new>See why our Auto MMI® is a leading indicator: download the Monthly MMI® Report.

On Monday, Anjumohan detailed how energy prices are impacting Brazil’s aluminum production industry. This section goes into further detail about the status of Brazil’s foundry industry.

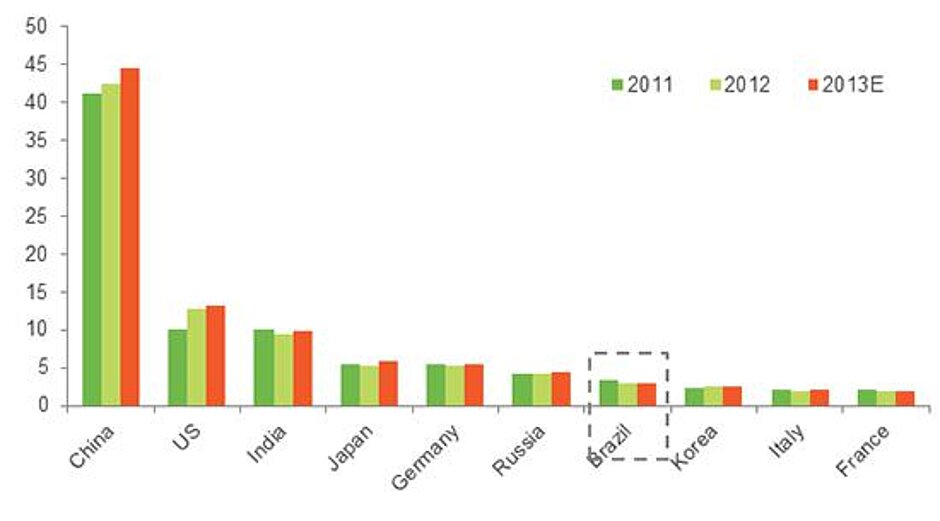

Brazil is the 7th-largest producer of metal castings considering total global production in 2012. For 2013, it is estimated that the Brazil’s metal production to be 2.96 million metric tonnes. As an exporter, in 2012 Brazil catered about 8.5% of US metal castings demand. Since 2011, Brazil has dropped significantly as an exporter of castings to the US. This is primarily due to the gain the in the Brazilian real against the dollar and the impact of higher energy cost in metal castings production.

The automotive industry is the major end use industry which drives metal castings production in Brazil. In 2014, the Brazilian automotive sector is expected to have challenges with stagnant or moderate growth. Despite increasing focus on productivity and cost optimization, profitability and competitiveness remains low.

Most of the aluminum produced in Brazil is consumed for domestic demand, especially for the automotive industry. Considering aluminum castings which are produced in Brazil, 95% are consumed locally. However, 5% are exported. With the rise in electricity prices and a supply deficit for aluminum as a raw material for castings, supply security could be an issue for the end use industries in years to come.

As an alternative, the Brazilian automotive industry could focus on the procurement of non-ferrous castings from Mexico, as the electricity rate in US dollars per kWh with Mexico is 16-18% lower compared to Brazil’s electricity rate in dollars per kWh. The raw material, labor and electricity are the major cost drivers in the production of metal castings. Considering the labor wage per hour, Mexico gains ground over Brazil. The average foundry labor wage per hour with Mexico is 40% lower than Brazil. With the procurement of metal castings from Mexico, the Brazilian automotive industry could experience a total cost savings for about 5-7%. Considering the foundry supply base and the labor productivity, both the regions holds similar labor productivity with an average of 2,300 metric tons production per plant.

Alternative Option for the Brazilian Automotive Industry

Considering the end use industries, the automotive industry in Brazil is estimated to reach an average of 5.2 million units of production in 2015 and 2016. It is clear that the global aluminum supply is about to enter the deficit space considering the end use demand and hence the aluminum prices are expected to rise by about 4-5% in 2015. In years to come, for the secured supply of aluminum castings i.e. aluminum cast parts for automotive industry such as oil pans, inlet manifolds for passenger vehicles, covers, bases, housings etc., the automotive manufacturers must focus in getting into a long term strategic partnership with the foundry by having raised inventory for aluminum and by getting into a fixed price agreements.

A note about the contributor: Beroe is the premier global provider of customized procurement services specializing in sourcing, supply chain visibility, financial risk analysis and environmental impact to Fortune 500 organizations. With nearly 400 dedicated procurement specialists in 38 domains, across 9 industries, Beroe proactively invests in knowledge assets to build valuable, real-time procurement insight.

Source: agmetalminer.com