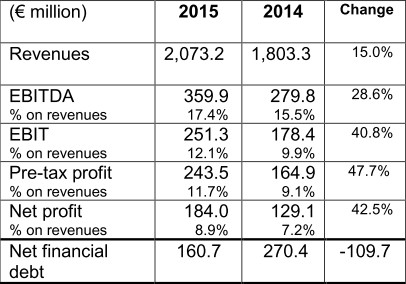

Compared to 2014 results:

- Revenues increased by 15.0% to €2,073.2 million

- Good growth of margins: EBITDA +28.6% to €359.9 million; EBIT +40.8% to €251.3 million

- Net profit grew by 42.5% to €184.0 million

- Net investments amounted to €154.1 million

- Net financial debt at €160.7 million

- Proposal to distribute an ordinary dividend of €0.80 per share

Results at 31 December 2015:

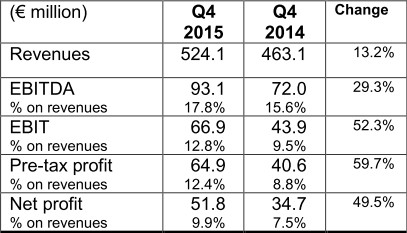

Q4 2015 results:

Chairman Alberto Bombassei stated: “We are particularly satisfied with our 2015 results. They were achieved thanks to the Company’s ability to operate on markets throughout the world, establishing itself as a global player. Growth was driven by the expansion of our product portfolio and our industrial footprint through the launch of a sound investment plan. These results were supported by both the Italian and European components of the business and those of other key geographical areas, such as the United States and China. I would like to recall that in a few days there will be the first casting at our new foundry in Homer, Michigan, while in the Beijing area, the acquisition-related activities announced at the end of 2015 will shortly begin.

The figures for the first few months of the year allow us to look to the future with prudent optimism, even in light of the emerging challenges and new opportunities that are currently marking the automotive industry. Brembo is able to effectively seize these opportunities, thanks not only to its timely completion of planned investments, but also its constant research and innovation commitment, which enables it to dynamically adapt to future industry developments. Brembo’s advanced research activities, primarily focused on mechatronic systems for the plants of the future and the development of new materials, are laying the foundations for facing the coming decade, which will see intensive vehicle electrification, with significant integration of brake systems and a constant emphasis on lighter products.”

Executive Deputy Chairman Matteo Tiraboschi stated:

“I believe it is important to highlight — amongst the various positive elements that can be inferred from the results approved today — that the Group’s profitability has increased significantly more than its sales. This is proof of our ability to optimize our production processes. In addition, our significant cash generation enables us to face a new cycle of investments in support of future growth, from a position of strength.”

Results at 31 December 2015

Brembo S.p.A.’s Board of Directors, chaired by Alberto Bombassei, met today and approved the Group’s annual results at 31 December 2015.

The Group's net consolidated revenues amounted to €2,073.2 million, up 15.0% compared to 2014. On a like-for-like exchange rate basis, revenues increased by 9.2%.

During the year, the car applications sector mostly contributed to growth, closing 2015 with an increase of 18.8% compared to 2014. However, there were also significant increases in motorbike applications (+11.6%) and the commercial vehicles sector (+10.4%). The racing sector declined by 4.7% in the reporting period due to the exclusion of Sabelt from the consolidation area effective 1 June 2015. On a like-for-like comparison, the racing sector grew by 10.8%.

At geographical level, almost all the areas in which the Group operates reported growth. Germany — Brembo’s second largest outlet market with 23.2% of sales — showed an 11.2% increase compared to 2014; the United Kingdom grew by 15.8%, Italy by 2.3%, whereas France reported a slight decline (-1.2%).

North America (USA, Canada and Mexico) — Brembo’s top market at 29.1% of sales — rose by 30.0%, whereas South America (Argentina, Brazil) reported a 21.0% decrease, also due to currency effect.

The main Asian markets showed a very healthy performance, with China growing by 29.2%, India by 26.3% and Japan by 39.0%.

In 2015, the cost of sales and other operating costs amounted to €1,366.3 million, with a 65.9% ratio to sales, down in percentage terms compared to 66.6% for the previous year. Personnel expenses amounted to €356.4 million with a 17.2% ratio to revenues, decreasing by over 1% from the previous year’s figure (18.3% of revenues).

At 31 December 2015, the workforce numbered 7,867, increasing by 177 compared to 2014. EBITDA for the year totalled €359.9 million (EBITDA margin: 17.4%), compared to €279.8 million (EBITDA margin: 15.5%) for 2014.

EBIT amounted to €251.3 million (EBIT margin: 12.1%) compared to €178.4 million (EBIT margin: 9.9%) for 2014. Depreciation and amortisation increased by 7.2% to €108.6 million due to the recent investments in new production facilities.

Net interest expense amounted to €7.8 million at 31 December 2015 (€13.7 million in 2014) and consisted of net exchange gains of €4.6 million (losses of €1.0 million in 2014) and net interest expense of €12.4 million (€12.7 million in the previous year).

Pre-tax profit was €243.5 million compared to €164.9 million for the previous year. Based on tax rates applicable under current tax regulations, estimated taxes amounted to €57.7 million, with a tax rate of 23.7%, compared to €36.2 million in 2014 (tax rate of 22.0%). Net profit amounted to €184.0 million, up by 42.5% compared to €129.1 million for the previous year.

Net financial debt at 31 December 2015 was €160.7 million, a €109.7 million improvement compared to 31 December 2014.

Results for the Fourth Quarter of 2015

In Q4 2015 alone, consolidated revenues amounted to €524.1 million, up by 13.2% compared to Q4 2014.

EBITDA amounted to €93.1 million (EBITDA margin: 17.8%), up by 29.3% compared to Q4 2014. EBIT totalled €66.9 million (EBIT margin: 12.8%), up by 52.3% compared to Q4 2014. The period ended with a net profit of €51.8 million, up 49.5% compared to Q4 2014.

Results of the Parent Company Brembo S.p.A. and Proposal for Allocation of Profit

Revenues of the Parent Company Brembo S.p.A. amounted to €780.8 million for 2015, up 9.5% compared to the previous year.

Net profit was €103.3 million, up 50.1% compared to the previous year. The General Shareholders’ Meeting will be called in accordance with the terms established by applicable laws and regulations to approve, inter alia, the following proposal for allocation of profit:

- a gross dividend of €0.80 per ordinary share outstanding at ex-coupon date;

- to the reserve pursuant to Article 6(2) of Italian Legislative Decree No. 38/2005, €0.3 million;

- the remaining amount carried forward. It will also be proposed that dividends should be paid as of 25 May 2016, ex-coupon No. 25 on 23 May 2016 (record date: 24 May).

Plan for the Buy-back and Sale of Own Shares

Today, the Board of Directors also approved the proposal for a new buy-back plan to be submitted to the forthcoming General Shareholders’ Meeting, with the purpose of:

- undertaking, directly or through intermediaries, any investments, including aimed at containing abnormal movements in stock prices, stabilising stock trading and supporting the liquidity of Company’s stock, so as to foster the regular conduct of trading beyond normal fluctuations related to market performance, without prejudice in any case to compliance with applicable statutory provisions;

- carrying out, in accordance with the Company’s strategic guidelines, share capital transactions or other transactions which make it necessary or appropriate to swap or transfer share packages through exchange, contribution, or any other available methods;

- buying back own shares as a medium-/long-term investment.

The proposal envisages the possibility for the Board of Directors to buy and/or dispose of, in one or more tranches, a maximum of 1,600,000 ordinary shares at a minimum price of €0.52 and a maximum price of €60.00 each.

Authorisation will be requested for a period of 18 months from the date of the resolution of the Shareholders' Meeting that grants said authorisation. At present, the Company holds 1,747,000 own shares representing 2.616% of share capital.

Foreseeable Evolution

The figures for the first few months of the year allow us to look to the future with prudent optimism, despite the highly volatile global scenario.

<link file:7714 _blank download file>![]() read more

read more

Source: brembo