(The video is only available in german)

There were remarkable good signs, when a lot of diecasting experts have met last week at EUROGUSS.

Get some close impressions now: From the official video to the guided press tour, the messages of the chairmen Mr. Gerhard Eder and Dr. Gutmann Habig up to the huge Foundry-Planet Gallery, where you meet all important exhibitors again.

<link http: www.euroguss.de de film-impressionen _blank external-link-new-window>

Click here for the Euroguss - Picture-Galleries 2010:

<link _top external-link-new-window suppliers>Euroguss 2010 - Machinery & Equipment

<link _top external-link-new-window foundries>Euroguss 2010 - Foundries

|  |

|  |

| Mr. Dr. Wolf with Mr. G. Eder (from the left) | Schenk Werkzeug & Maschinenbau |

|  |

| Dr. Wolf with Dr.-Ing. Ioannis Ioannidis | a very well attended after-business party |

| Statement by Gerhard Eder, Chairman of the Verband Deutscher Druckgießereien On behalf of the Verband Deutscher Druckgießereien, the honorary sponsor of the 8th International Trade Fair for Die Casting, may I welcome you to Nürnberg and thank you for your interest in our industry. |

| Mr. Gerhard Eder with Mr. Dr. Gutman Habig |

Charts:

•Chart 1:

Structural data for German die casting industry

•Chart 2:

Die casting production by types of metal in the Federal Republic of Germany

(1988 – 2008)

•Chart 3:

Sales of alloy die castings (aluminium and magnesium) by customer groups (1993 – 2008)

•Chart 4:

Sales of zinc die castings by customer groups (1993 – 2008)

•Chart 5:

Sales of alloy die castings in 2008 in per cent

•Chart 6:

Sales of zinc die castings in 2008 in per cent

<link file:7366 download> Charts.pdf.

Charts.pdf.

As you can see from the charts, the production of die castings has grown continuously over the past years and decades. No other casting process has shown comparable dynamic. The die casting foundries as component suppliers to car manufacturers, machinery and plant manufacturers and other branches of industry, such as communication technology, the furniture industry and the electrical and electronics industries have continuously gained in importance, even though growth rates in the last two years levelled out slightly. Then came the slump last year, as in other branches of industry too.

Nevertheless, I would like to say that the production upturn experienced by the die casting foundries in Germany and Europe in the past decades clearly exceeds the figures for other industries and for other casting processes too. There are many indications that this trend will continue in the short and medium term, although the industry faces tremendous competition in our country.

In times of globalization, it would be foolhardy not to expect that die castings can also be manufactured abroad, and at distinctly more favourable terms than at our locations. So it only remains for us to be better than the “cheap foreign competition”. The share of personnel costs in our firms is now more than 50 % of the total costs (without metal). In the OECD international comparison, Germany still holds third place in terms of labour costs, which does not make economic operation of production firms in our country easy. The discussion on legal minimum wages also affects us. With our collective wage agreements for the metal industry, we are not involved directly, but the large share of temporary workers now employed in our industry means we will no doubt also have to consider this factor in our cost structure.

Another issue for us is the continually rising cost of energy, which in comparison with many other production locations abroad is simply no longer competitive. This may well be politically desired in Germany, but it represents a substantial burden for an energy-intensive industry like the foundry industry in general and die casting foundries in particular.

Another issue that has become increasingly relevant and controversial for our industry in the past years is the development of costs for metal raw materials. The metals used in our die casting foundries are usually made from recycled scrap metal. In this respect, the industry plays a considerable role in the flow of recycled metal components. Due to the enormous need for raw materials of all kinds, especially in the Asian region, this constantly leads to tremendous leaps in the prices of raw materials for our industry. If the die casting foundries want to remain profitable, these increases must be passed on to the market, which is not always easy. Particularly the main customer, the automotive industry, presents its own cost-cutting programmes aimed at purchasing “cost-optimized” components – in other words, at lower prices! Here the industry faces a permanent pressure on prices in its own market, which it must decisively oppose – if it wishes to survive in the medium term!

The most important application market for die cast products is and remains the automotive industry, whose weakness has hit our industry with full force. However, we also see opportunities for our products that are appreciably greater than the risks. Die castings are an essential part of modern and efficient cars. As die casting only pays off in large quantities, this process is especially interesting for component products in the automotive industry, such as engine blocks, chassis parts, steering and brake systems, gearbox components, gearbox housings and interior parts. The persistent pressure on replacing parts in favour of lightweight materials remains a major growth motor for the production of aluminium and magnesium castings, especially using the die casting process.

Realistically, we will have to forego the growth rates of the past boom years in the near future. The large market growth in markets like China and India will be covered largely within these countries. A German component supplier can benefit from this at best only indirectly. The large car manufacturers have set up their own production facilities in the prospering Far East countries, which hardly creates job security in Germany or Europe. Scrapping bonuses or comparable schemes at European level have made our market even tighter. The market for mid-range and top-range cars will not grow disproportionately either and the demand for commercial vehicles has slumped drastically. These markets will stagnate and a ray of sunshine can hardly be detected here for 2010. However, I do hope that the automotive industry will start growing again in the second half of 2010.

From an optimistic viewpoint, our association assumes that the present growth of castings could stabilize at about 10 % in 2010 in the best case. The die casting foundries will no doubt need 2011 and possibly even 2012 to return to the level of 2006 and 2007. The situation is different for die casting foundries in those industries that are still flourishing, such as power systems, medical engineering and parts of the electrical industry. The declines here are only minor – if at all. These industries need smaller batch sizes, which are just right for SME suppliers.

Despite the present crisis, I assess the medium-term prospects for us die casters as positive! If we turn to our skills, push innovations and focus on engineering thinking again, we have a good chance of coping with the crisis. Due to the high production rates in the past years, we have concentrated more and more on optimizing production flows and shortening casting cycles, and have possibly neglected improving the casting process as such. In this respect, an event like EUROGUSS can only help us to gain new knowledge of these technical operations.

We also still need well-trained employees in the future, as they represent the chance of survival for our industry. Almost all die casting foundries are therefore continuing to invest in training, for we need competent skilled workers and excellent engineers in the future, whose ideas can promote the advancement of the industry. Moreover, we should pay more attention to our materials again, i.e. also carry out fundamental research in this field. In this way, small and medium enterprises, which still constitute the bulk of die casting foundries, can also contribute towards responding flexibly to customer requirements – in the future too!

Presentation Dr. Habig

European Committee of the Manufacturers of Materials and Products for Foundries

What is CEMAFON?

The European Committee of the Manufacturers of Materials and Products for Foundries (founded in 1972)

- embraces the respective national associations and thus all major

manufacturers of foundry machinery and plant, furnaces and products for the foundry industry in Europe - represents the economic and technical interests of its members worldwide, offers information and creates a platform for the exchange of views at European level

- the representative voice of the European foundry machinery industry

- a source of information on markets and technical developments

- the lobbying platform for members’ interests especially concerning

- harmonization of European safety standards under the Machinery Directive

- support for exhibitions in Germany and abroad

- creation of “guidelines” for specifying technical rules and agreements (e.g. on interface issues, die

casting machinery and peripheral equipment) - the platform for dialogue with customers and organizations in Europe and the world

CEMAFON members

Foundry machinery manufacturers

- CEMAFON represents approx. 160 European manufacturers of foundry machinery

with a production volume of over € 1 billion. - These firms account for almost 90% of the European industry’s production volume

and hold an approx. 40% share of total world exports. - Die casting machinery manufacturers

- CEMAFON represents practically all well-known European die casting machinery

manufacturers with a production volume of approx. € 300 million. Their share of total

world exports is approx. 40%

<link file:7367 _blank download> |  <link file:7368 _blank download> |

<link file:7369 _blank download> |  <link file:7370 _blank download> |

Market trends

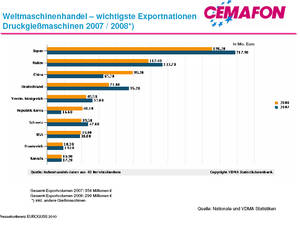

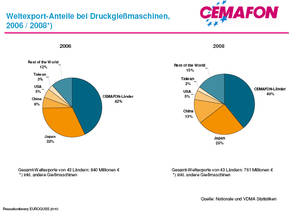

2008: More growth for Asian manufacturers (China, Korea), China moves up to 3rd place in the ranking of export nations for die casting machinery (2nd place for total foundry machinery and equipment)

- World export market for die casting machinery: declining since 2007

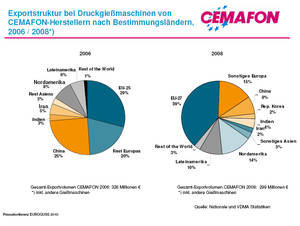

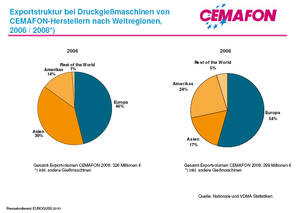

(2006: € 840 million, 2007: € 798 million, 2008: € 761 million) - CEMAFON exports: approx. 40% share of world market;

CEMAFON export structure: increased shares for EU-27 and America,

declines in Asia (especially China) - 2009: Overall situation in the foundry machinery industry marked by heavy drop in

sales (e.g. -40% in Germany), even larger drop in orders received –

trough seems to have been reached in Q4/2009, slight upward trend (EU + export),

but no return to positive sales growth expected in 2010 (possibly approx. -20%) - Crisis was noticeable at a very early stage in the die casting sector (2nd half of 2008)

– die casting still strongly associated with automotive applications (approx. 80%)

Exhibitions

The following international exhibitions are supported:

- METEF/FOUNDEQ, 14-17 April 2010, Brescia

- METAL & METALLURGY China, 11-14 May 2010,

Peking - Metallurgy-Litmash, 24-27 May 2010, Moscow

- ALUMINIUM, 14-16 September 2010, Essen

- ANKIROS/ANNOFER, 11-14 November 2010,

Istanbul - GIFA, June 2011, Düsseldorf

For more information: <link http: www.euroguss.de>