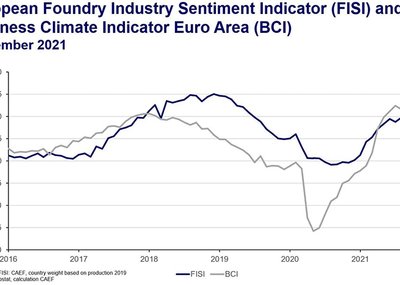

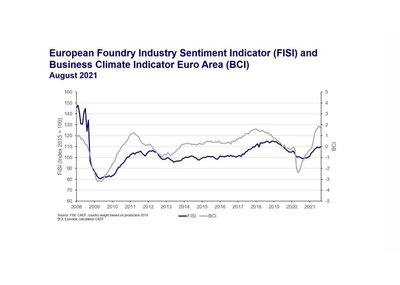

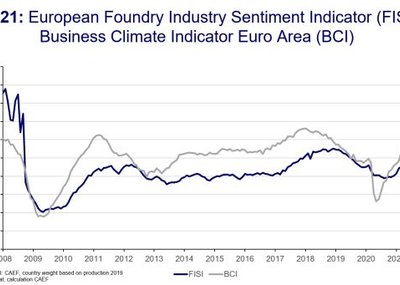

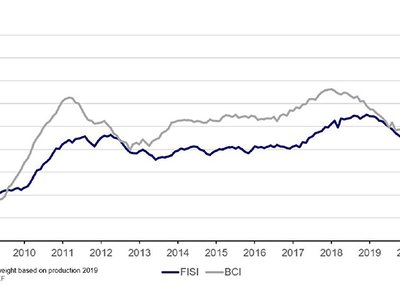

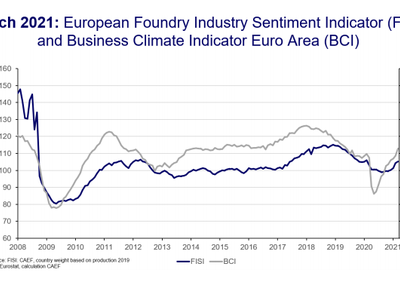

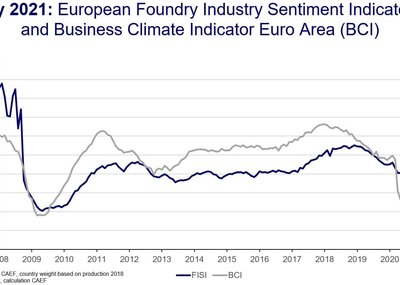

In April, the FISI rises for the fifth time in a row. The recovery is driven by both non-ferrous metal foundries and iron foundries. The improvement in the current situation and expectations for the next six months are equally responsible for the increase of 1.9 index points. The new value of 107.2 points is at the level of September 2019. The order range of the European foundries has recently increased significantly.

While the positive expectations for the next six months continue to point to a stable development, material shortages nevertheless threaten to impair the important recovery process. A major influence on the positive expectations is likely to be the declining Covid-19 infection figures in large parts of Europe. Progress on vaccinations has also picked up considerably in many places recently, so that restrictions on public life will be gradually eased over the next days and weeks. Meanwhile, the BCI has seen by far its largest monthly increase since calculations began in 1985. It climbed by 0.82 points to a new index value of 1.31.

While the People's Republic of China has been out of the crisis since the middle of last year and the United States has also been reporting positive production figures for some time, the European economies are finally following suit with a delay. European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance.

It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. Please find the chart enclosed or combined with additional information at www.caef.eu