FROM SOPHIE STEFFEN, DÜSSELDORF

After the year 2019 was already characterized by a wide range of uncertainties and unstable economic policy conditions and German industry had been in recession since the fourth quarter of 2018, it still looked like a trend reversal for 2020 with subsequently more stable business. Since the outbreak of the coronavirus in China and the global spread of the new pathogen, the tide has turned and will keep the economy in suspense in the coming months. At this point, a note: In addition to the corona pandemic, other important economic and political issues are currently disappearing in the general public and media landscape. Nevertheless, you should definitely keep an eye on them. The many factors of uncertainty that affect companies' propensity to invest include: Brexit, existing trade conflicts between the economic powers and conflicts in the Middle East (Saudi Arabia and Russia) with uncertainty signals regarding oil and gas prices. The extent of the pandemic is not yet foreseeable. The consequences for the economy can hardly be predicted and depend heavily on the length and depth of the health protection measures. Economic research institutes therefore view different scenarios as likely. If protective measures are gradually loosened from summer onwards, a gradual recovery in the second half of 2020 may be expected. By 2021 at the latest, catch-up effects should stimulate the German economy. Now looking back at 2019:

German cast production 2019: total figures

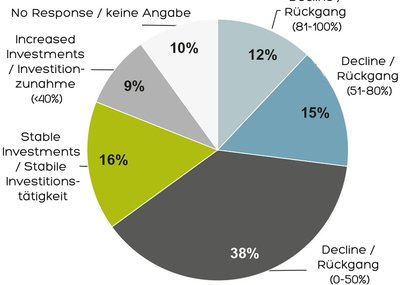

The German foundry industry shrank last year by 8.9% to a total production (Fe and NE) of 4,950 million t. Their sales also fell - by 8.5% to EUR 12.430 billion. As in previous years, there was a heterogeneous development in the individual material groups: with 3.805 million tonnes, the iron and steel foundries produced 10.6% less than in 2018. The production of non-ferrous metal founders shrank more moderately. 1.146 million t means a minus of 2.6%.

To put it in a nutshell: The decline compared to the extraordinarily high 2018 level is clear, but the production still corresponds to the level of 2010. Also in 2019, vehicle construction was by far the most important customer branch of the foundry industry with around 60%, followed by the machine - and plant construction with 20% of the total cast components. In the area of other cast components, which also accounted for 20 percent, there are many parts for mechanical engineering, as a clear demarcation e.g. between mechanical engineering and electrical engineering is no longer possible.

Three factors reduced the number of orders

The customer industries in the foundry industry can look back on a challenging year due to weaker international demand. In particular, three factors led to lower orders: a slowing global economy, structural change in the automotive industry and numerous politically motivated upheavals - such as Brexit and ongoing trade disputes between the USA and China and the EU. All of this led to high uncertainties and had a braking effect on the propensity to invest. For the foundry industry, this meant a noticeable decline in order intake regardless of the material. For vehicle construction, the iron and steel foundries produced 2.087 million tons in 2019, 10.5% fewer components than in the previous year.

This shows the increasing influence of the factory conversions of leading OEMs on e-mobility. There was also a 2.3% decline on the non-ferrous metals side to 0.919 million t. Declining orders from German mechanical and plant engineering led to a decline in production of iron and steel founders by 15.5% to 0.933 million tons. The German non-ferrous metal founders even had to accept a decrease of 16.6%. Because of the high export intensity, many branches of mechanical engineering suffer from global uncertainties. The minus rate was very different in the casting-intensive divisions.

Outlook 2020 - how it could have happened

At the beginning of 2020, it looked as if the German foundries still had a good chance of maintaining the 2019 production level in the final balance of the year. A bottoming out in the course of the first half of the year and a slow recovery in the second half of the year were considered to be quite realistic. With the additional factor "corona virus", the situation changes fundamentally for the rest of the year.

Outlook 2020 - status quo with coronavirus

Due to the spread of the coronavirus, the outlook for 2020 set out at the beginning of the year is now waste. The exogenous shock will hit Germany and the global economy to an unknown extent. Because what is special about the new virus for the economy is that there is a simultaneous supply and demand shock. In addition, the effects are already clearly noticeable on the financial markets.

The stock exchanges around the world reacted in March with individual daily record losses. The most important indices, including the German Dax, are several thousand points below their highs, reflecting the clearly negative expectations of investors. But what does the virus outbreak mean for the German foundry industry? For a more precise classification, a look at the core sales markets of vehicle and mechanical engineering follows.

Vehicle construction - situation at the OEMs

At the beginning of the corona pandemic, the Chinese city of Wuhan in the Hubei region was primarily affected. After curfews were put in place to curb the spread, the automotive hub also saw production stops by European OEMs. As a result, - with a time lag - disruptions in the global supply chains were expected, as many companies procure primary products from China. In addition, the demand for cars collapsed. After sales figures were already 10% lower in 2018 than in 2018, the drop in registrations in January increased to minus 20%. In February, the Corona crisis hit hard: the passenger car market volume collapsed by 82%.

This development is now also to be feared for other countries. The number of infected people is increasing globally every day. Northern Italy and Spain in particular are particularly hard hit and are currently fighting the virus. Car manufacturers are currently examining the extent to which they can produce medical technology and protective equipment, such as masks, in their plants. Due to Covid 19 cases in German automotive plants, these also had to be closed in rows, while in China production slowly started up again in 1-shift operation. For the time being, compliance with the European CO2 emissions standards for passenger cars is taking a back seat (95% of new registrations may not exceed CO2 emissions of 95 grams per kilometer on average).

Vehicle manufacturing - worldwide decline in demand for cars

In general, demand for passenger cars is expected to plummet worldwide in the first half of 2020. Independent forecasting institutions such as LMC Automotive already assumed in their Corona Pandemic scenario in February that a 10% decline in production for 2020 should be expected for the Chinese passenger car market. The European market is also likely to be under considerable pressure in 2020. The VDA has so far not issued an officially adjusted forecast for the German and European automotive market. Industry analyst Ferdinand Dudenhöffer expects sales in Western Europe to decline by 11%, however, depending on the further course of the pandemic in Europe, the figures could be even lower. For 2020, he anticipates a corona-related decline in sales of one million. Dudenhöffer also expects the Western European automotive market to take a decade to return to 2019 levels.

Mechanical engineering

In addition to the German foundries, the machine builders are also concerned about the car industry's production stops. The VDMA temporarily lowered its production forecast from minus 2% to minus 5%. In a flash survey by the VDMA, 60% of the companies indicated that the supply chains were affected, particularly by Italy and China. German foundries were occasionally able to take advantage of the opportunity and take on orders to ensure the production of important components. This shows that in such times it is necessary not to close foundries in general. Because they often produce key components that are required to keep a machine running, which in turn is required for the production of essential goods.

Corona virus - also positive outlook?

First, on the aspect of the companies' immediate economic management of the situation: foundries will report liquidity shortages. The concrete political options for action by the European Union as well as the federal and state governments to support German SMEs in this crisis are currently being discussed. It is essential that the help reaches the companies on site. Nothing should be glossed over at this point: The effect of the corona pandemic is clear, predominantly negative and thus also a major risk factor for the German foundry industry. At the same time, there are occasional opportunities. Because now is the right time to convince customers to increasingly order castings again in Germany. Since production ceased in China, global supply chains have been increasingly evaluated and reconsidered. The establishment of a second supplier and thus the concept of dual sourcing could be an option for many foundry customers in the future to ensure the delivery of preliminary products.

Now one should not expect that purchasing leaves the price-controlled approach and is no longer globally oriented, first examples from the industry prove this, but there are many advantages to ordering from domestic companies - such as short transport routes, prompt delivery, reliability and high quality On the hand. However, in times of functioning global supply chains, they are not the decisive factor for an order. In times of crisis, however, these aspects become all the more important. However, there is a chance that orders will at least partially remain with German companies in the long term. Knowing that many foundries initially struggle with the immediate, operational management of the new situation, these positive aspects are only hinted at here. In retrospect, the Corona crisis can be analyzed retrospectively from an economic perspective and the lessons outlined here can be discussed in depth.