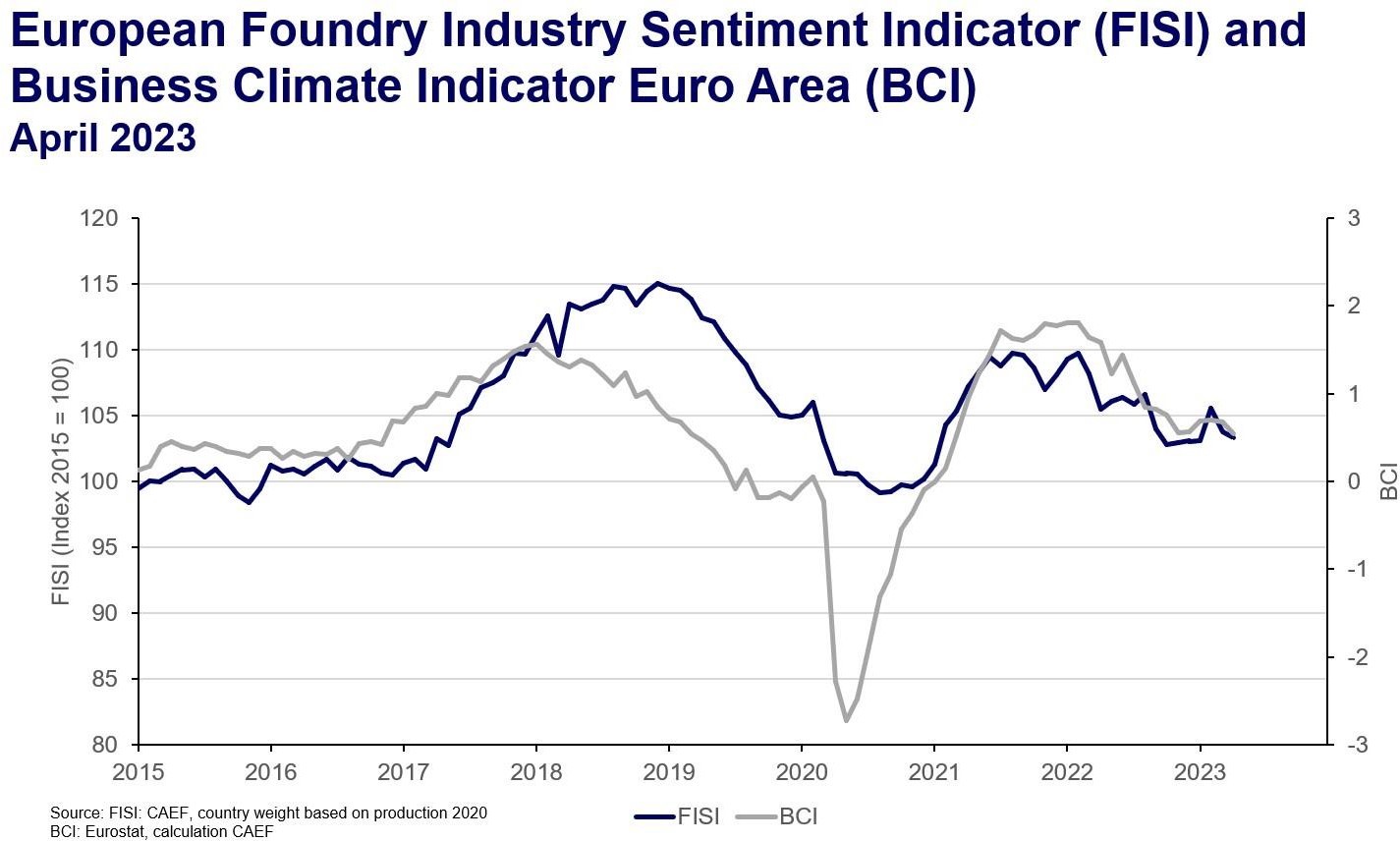

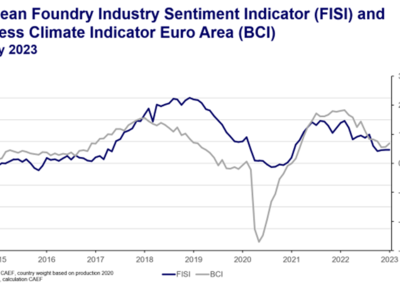

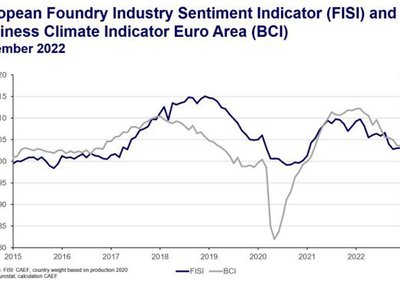

European foundries recently assessed the current business situation as better than in the previous month. Expectations for the coming six months, on the other hand, were more pessimistic. This is in contrast to the development of the past months, in which the significant gap between pessimistic expectations and a positive assessment of the situation began to diminish.

Working off the order backlog leads to a more positive assessment of the current business situation than a month ago. It is to be expected that the situation will deteriorate again over the coming months if order impulses do not become noticeable in the long term.

The Business Climate Indicator (BCI) decreases by 0.14 points in April and brings the index to 0.54 points. Overall, the selling price expectations for the month ahead are decreasing together with the production expectation for the month ahead in comparison to the previous month starting from a high level. A negative stimulus is furthermore noted by the reduction of the assessment of order-book levels.