Forecast slightly increased

- Consolidated sales grow by 8.0% to €2,808 million in the first half of the year

- Operating earnings for the Group improve by 30% to €134 million

- Automotive increases sales to €1,465 million and operating margin to 8.8%

- Sales growth of 7.4% to €1,343 million and improvement in earnings of €12 million to €14 million in Defence

- Order backlog for the Group of €7.1 billion

The Rheinmetall Group, based in Düsseldorf, closed the first half of the year with considerable sales growth and a strong increase in operating earnings. This upward trend was driven by both of the technology group’s sectors.

Based on the good business performance in the first half of 2017, Rheinmetall increased its forecast for the Group’s sales and operating margin.

Rheinmetall is now aiming for organic sales growth of around 6% in the fiscal year, based on annual sales of €5.6 billion in 2016. Growth of between 4% and 5% had been previously anticipated.

Armin Papperger, CEO of Rheinmetall AG: “We closed the first half of the year with success. As a result, we can now raise our targets somewhat and revise our forecast upwards. The large orders placed by the German armed forces and international customers show that we are benefiting from the global rise in demand for defence and security products with our Defence sector. Automotive is in the best position to continue achieving profitable growth with future-oriented technologies, optimized cost structures and a global network. In addition, it is also clear that we are highlighting our role as a leading supplier for the automotive sector with electromobility products.”

In the first half of 2017, Rheinmetall achieved a year-on-year increase in consolidated sales by €209 million or 8.0% to €2,808 million. The proportion of business activities abroad remained at a high level of 78%.

The Group’s operating earnings posted above-average growth by €31 million or 30% to €134 million. Automotive contributed €17 million to this improvement. In addition, €12 million of this increase in earnings relates to Defence, while another €2 million is attributable to Other/Consolidation.

The order backlog in the Rheinmetall Group remained at a record level. It amounted to €7.1 billion as at June 30, 2017, after €7.3 billion at the end of the reporting period in the previous year.

Automotive: Rise in sales, margin increases to 8.8%

Rheinmetall Automotive generated sales of €1,465 million in the first half of 2017, an increase of 8.6% from the previous year’s figure (€1,349 million). Operating earnings rose from €112 million to €129 million. As a result, the operating margin further improved to 8.8% after 8.3% in the same period of the previous year.

The Mechatronic division raised its sales by 10% to €832 million in the first half of the year. This increase led to a 30% rise in operating earnings to €90 million.

In the first half of 2017, the Hardparts division generated €500 million in sales and thus a year-on-year upturn of 5.5%. The large-bore piston business continued its recovery. The small-bore piston business in Europe saw a slight increase, while sales in Brazil benefited from currency effects. The division’s operating earnings amounted to €33 million in the first six months of the year (+14%).

Sales in the Aftermarket division grew by 12% to €176 million. This is mainly attributable to the products sold by the Group’s brands, Kolbenschmidt and Pierburg, in the sales regions of Western and Eastern Europe. The division’s operating earnings rose by €3 million to €16 million (+23%).

There were also expenses of -€10 million for additions to provisions for environmental risks and R&D projects in the area of electromobility.

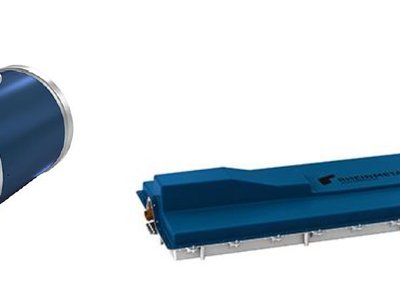

Rheinmetall Automotive has already acquired orders in the area of electromobility that are worth almost €500 million altogether. Casings for electric motors, components for battery boxes, and a wide range of pumps and valves have already been ordered by various car manufacturers in Germany and China. These will be used for both electric vehicles and hybrid vehicles.

Chinese companies continue to grow

The companies in China posted another significantly better performance compared to the local market. While light vehicle production in China grew 3% year-on-year in the first half of 2017, the Chinese companies increased their sales by 6% to €490 million in the first half of 2017. Operating earnings rose by 15% to €37 million in the same period.

The wholly owned subsidiaries in China enjoyed a particularly dynamic performance with an increase in sales of 34% to €63 million.

Defence: Sales and operating results further improve

At €1,343 million, the Defence sector’s sales rose significantly by €93 million or 7.4% in the first quarter compared to €1,250 million in the previous year.

Operating earnings improved by €12 million from €2 million in the previous year to €14 million in the period under review.

Rheinmetall Defence posted an order intake of €1,422 million in the first half of 2017 and thus remained below the prior-year figure of €1,751 million. This is mainly due to a weaker first quarter. The second quarter of 2017 saw a significantly higher order intake compared to the previous year. After €803 million in Q2 2016, orders worth €1,031 million were entered into the books in Q2 2017. This represents an increase of 28%.

A number of large orders placed by the German armed forces with Rheinmetall with a total value of over €750 million were given parliamentary approval in June 2017.

A soldier system order worth €310 million was entered into the books as the first of these major orders at the end of June. However, most of these orders, with a value of around €458 million, have been or will be contracted from July 2017 onwards and will therefore be entered into the books in the second half of the year.

The sector’s order backlog remains at a high level of €6.7 billion (June 30, 2017).

The Vehicle Systems division achieved an increase in sales of €139 million or 25% to €687 million, making it the main driver of the positive development in the Defence sector. This sales growth was primarily driven by the large order for military utility vehicles in Australia, which is now being implemented. The division’s operating earnings improved significantly by €20 million to €15 million.

At €496 million, sales in the Weapon and Ammunition division slightly exceeded the previous year’s figure (€493 million). Operating earnings amounted to €12 million and thus decreased year-on-year (€20 million). This is mainly due to the higher proportion of sales resulting from intra-Group orders realized in the second quarter with a lower margin as against the strong-margin customer orders placed in the same quarter of the previous year.

The Electronic Solutions division reported sales of €279 million and continued to fall short of the previous year’s figure by €50 million. Despite this decrease, operating losses remained at the level of the previous year (-€5 million).

Forecast: Sales growth in both corporate sectors

Rheinmetall Group expects to continue its growth course in fiscal 2017. In view of the Automotive sector’s positive business performance in the first half of 2017, Rheinmetall is increasing its growth forecast for this sector and the Group. Based on current expert forecasts regarding trends in global automotive production, which currently anticipate an increase in production of 1.8% this year, Rheinmetall now expects to achieve sales growth of between 6% and 7% in the Automotive sector. The company had previously anticipated sales growth of between 3% and 4%.

Rheinmetall still projects sales growth of 5% to 6% for the Defence sector in fiscal 2017. As a result, the forecast for the Group’s annual sales – based on €5.6 billion in 2016 – has increased, and organic growth of around 6% is anticipated for the current fiscal year. Growth of between 4% and 5% had been anticipated at the Group level.

Improvement in earnings and consolidation of profitability

The margin forecast for Rheinmetall Automotive has been adjusted. As in the previous year, Rheinmetall anticipates an operating margin of around 8.4% for the current fiscal year as well. An operating margin of at least 8% had been previously forecast. In the Automotive sector, the company’s management is currently examining further optimizations of the cost and site structure of plants, particularly in the Hardparts division.

Rheinmetall continues to expect earnings to improve in the Defence sector in 2017 and anticipates an operating earnings margin of between 5.0% and 5.5%.

Taking into account holding costs of €20 million to €25 million, this results in a slight increase in the operating margin of around 6.5% for the Rheinmetall Group. Rheinmetall had previously anticipated a margin of 6.3% at Group level, as in the previous year.

Source: Rheinmetall Group

Partner

Foundry Daily News

Rheinmetall continues on growth path

Reading time: min

[0]