Hollingsworth Logistics Group LLC, a Dearborn-based automotive transportation and assembly supplier, plans for sales in Mexico to be a quarter of its business by 2025.

That's an ambitious target, considering none of the company's $400 million in revenue in 2014 came from that nation.

But Hollingsworth isn't alone, as Southeast Michigan's lower-tiered supply base is again heading south — 20 years after the North American Free Trade Agreement broke business barriers further open between the U.S. and Mexico.

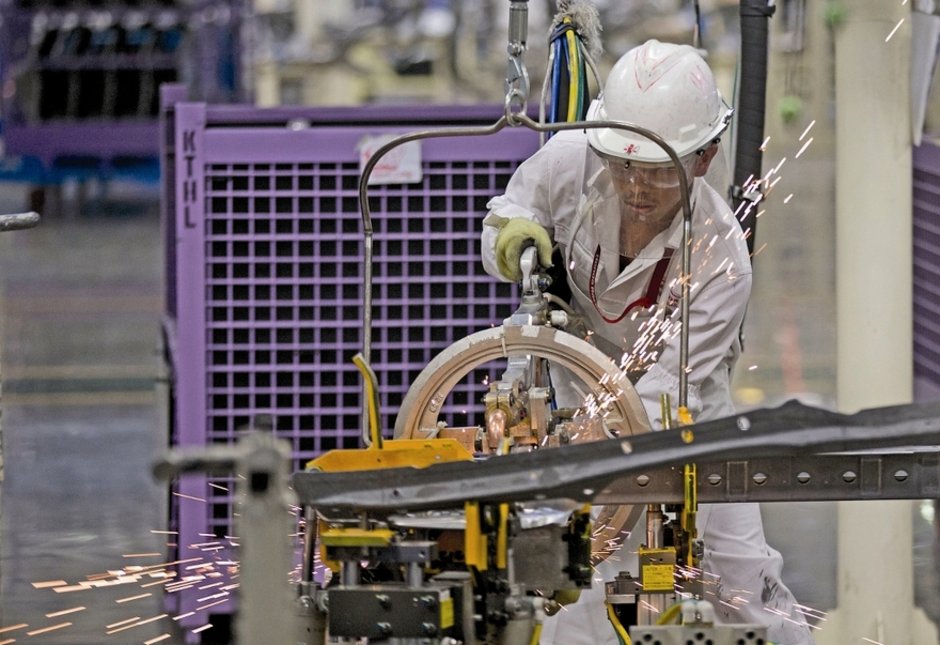

In what local experts are calling the new automotive gold rush, automakers such as Nissan Motor Co. and Mazda Motor Corp. are producing a record number of vehicles in Mexico, most of them destined for export.

Since 2012, carmakers have invested or promised nearly $23 billion in new production in Mexico. In April, Toyota Motor Corp. announced it would spend about $1 billion on its first car factory in Mexico, with the capacity to assemble about 200,000 Corolla compact cars annually, Bloomberg News reported.

The result is a need for a more cohesive supply chain that extends farther down the tiered system, including assemblers and distributors such as Hollingsworth.

"Mexico is booming, and what we see trending is phenomenal opportunities for us," said Greg Martinez Jr., director of international sales for Hollingsworth. "It's key for our sustainability. If we, and others, don't make those business expansions down there, the marketplace will become much smaller."

Rapid expansion

Hollingsworth — minority-owned and controlled by Stephen Barr, who is of American Indian decent — is bidding on four programs in Mexico for distribution services and commodity management for FCA US LLC, Ford Motor Co. and Bombardier Inc., Martinez said.

Mike Wall, director of automotive analysis for Southfield-based IHS Automotive Inc., said that the tier structure in Mexico is "vastly underdeveloped" but that the projected volume coming out of the country is forcing automakers and suppliers to ensure their chain is more robust.

"The volumes are there, and as more automakers go down to Mexico, an infrastructure is being created that can support more suppliers down the line," Wall said. "New plants are coming on board in the next few years, and they are already quoting that business.

"The reality is, if you want that business, you've got to be down there because automakers aren't looking for parts to be shipped in anymore."

Automakers in Mexico produced 3.2 million vehicles in 2014, surpassing Brazil's 3.1 million to become the seventh-largest producer of vehicles. China and the U.S. remain the largest producers of cars in the world.

Production in Mexico is projected to top 4 million in 2017, according to IHS, as it gets closer to the country's plans to reach 5 million units by 2020. This would move them ahead of India and South Korea in production.

Labor costs

Low labor costs and favorable trade agreements with more than 45 countries make Mexico an attractive location for Southeast Michigan suppliers looking for global expansion.

An average unskilled laborer in Mexico costs $8 an hour, including wages and benefits, according to data from the Ann Arbor-based Center for Automotive Research. Comparatively, similar workers for General Motors Co. cost $58 an hour.

Although cheap labor is a benefit, Wall said, labor rates will rise.

"I don't think the move to Mexico is just a labor solution; it's not the endgame," he said. "Just as labor cost is rising in China, the whole labor cost benefit in Mexico will turn on its head eventually."

Alejandro Rodriguez, country manager for Southfield-based Plante & Moran PLLC in Monterrey, Mexico, said constraints on the labor force will occur as the need for skilled workers and engineers rises.

"There's already more demand than supply for the highly skilled workers," Rodriguez said. "It's a complete misconception that labor is inexpensive overall. ... There's a huge gap between skilled and unskilled labor."

For instance, suppliers and automakers are likely to pay more for a plant manager in Mexico than in the U.S., Rodriguez said, because fewer people are qualified for those positions in Mexico. That creates demand that raises pay.

The next labor challenge in Mexico will be retaining talent — a familiar challenge to Southeast Michigan suppliers, Rodriquez said.

"You can't manage your operations in Mexico with just expats; you must build a culture there," Rodriquez said. "Not everything is about money for Mexicans. They want to feel part of something larger, just like their American counterparts."

While issues with labor are bound to crop up, it's Mexico's expansive trade agreements with more than 40 countries that have driven the global auto industry into the country, experts said.

Mexico's strong agreements allow exporters duty-free access to markets that contain 60 percent of the world's economic output, The Wall Street Journal reported this year.

Automotive exports from Mexico this year are projected to rise to a record 2.9 million vehicles, more than 87 percent of its projected production, according to the Mexican Automobile Industry Association. As much as 70 percent of those exports are projected to be going to the U.S.

For Hollingsworth, exporting isn't one of its options, but the increased exports from Mexico are a welcome catalyst to its own growth.

"Customers are looking for suppliers that can deliver their services on an international level," Martinez said. "If we're not down there as soon as possible, we're not going to be able to compete long term."

Source: crainsdetroit.com

×