Interest from manufacturers and big chemical companies shows that 3-D printing isn’t just for hobbyists

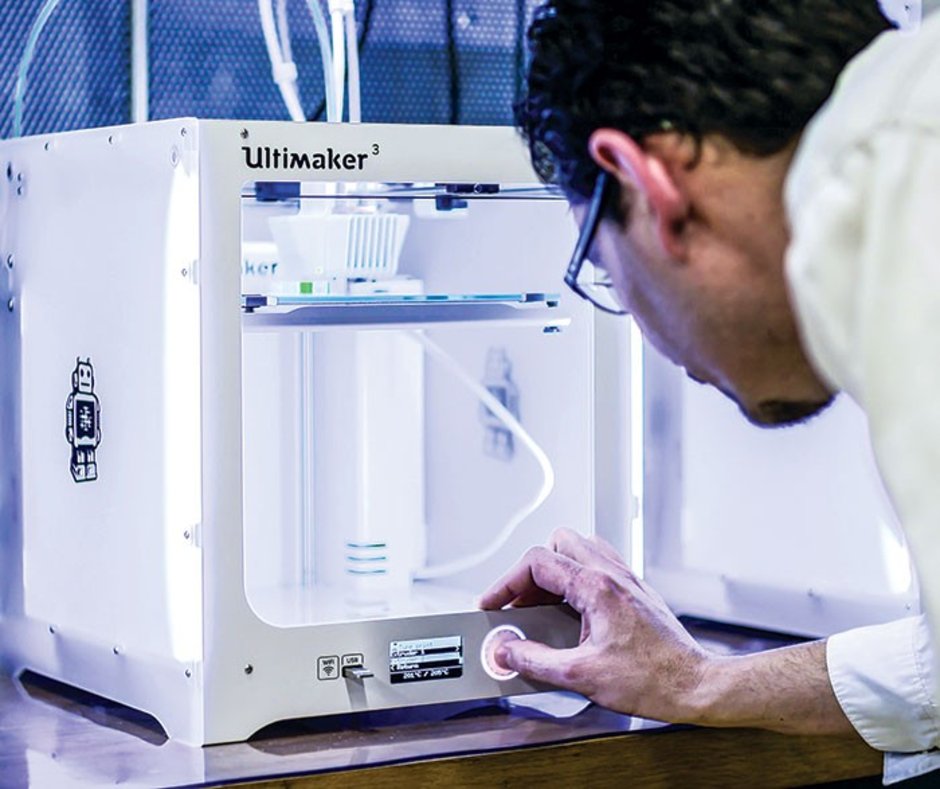

At its Autoeuropa factory in Portugal, where it assembles 100,000 cars a year, Volkswagen has deployed a fleet of desktop three-dimensional printers made by the Dutch firm Ultimaker. Last year, the machines printed more than 1,000 plastic tools and fixtures Volkswagen needed around the plant. One example is a plastic jig that workers place over the wheel so they can tighten lug nuts without scratching the rim.

Previously, Volkswagen had to rely on third parties, such as machine shops, to fabricate such parts. Between sending the design out, waiting for delivery, and testing, the process for making a simple object like a window alignment gauge could take 60 days. With 3-D printing, workers have the parts in their hands in less than a week.

The new method is also cheaper. Volkswagen says the printers paid for themselves in just two months and that the factory saved a total of $150,000 last year. The company expects to save a quarter-million dollars this year.

“In addition to the time and cost savings we realized, the tools we output are more complex and ergonomic and, ultimately, far more useful in our day-to-day operations because they are tailored to our needs,” says Luis Pascoa, a production manager at Volkswagen.

Manufacturers are indeed adopting 3-D printing. That doesn’t mean that 3-D printing is living up to the hype of a few years ago. Factories aren’t yet printing parts on a large scale, and consumers aren’t making finished goods for themselves at home. But industrial firms like Volkswagen are beginning to 3-D print the tools, jigs, and fixtures they need every day.

In addition, metal fabrication shops are using the technology to make molds for casting metal parts. Engineers are 3-D printing prototypes they can test. And some firms are printing limited quantities of plastic parts for custom-made finished products.

Polymer makers such as BASF, NatureWorks, SABIC, and Trinseo have noticed the trend. Blasé at first, they are coming to realize that their materials science expertise can be good for the 3-D-printing industry and that the fledgling industry in turn can be good for their businesses.

Drawing these chemical companies’ attention is the rapid adoption of fused filament fabrication (FFF) printers, relatively inexpensive machines that make parts out of thermoplastics. In FFF, also known as material extrusion technology or fused deposition modeling, the printer uses a computer-generated 3-D rendering to trace out cross sections of the part, layer by layer, with a heated thermoplastic filament. The process can take a few hours. Common materials include acrylonitrile-butadiene-styrene (ABS) resin, nylon, and polylactic acid—products that chemical companies already produce for other markets.

Other printing techniques include laser sintering, in which lasers trace the shapes of parts from a vat of thermoplastic resin or metal, and stereolithography, in which lasers cure acrylic and epoxy photopolymers.

The global market for 3-D-printing materials and equipment was $2.7 billion last year, according to “Wohlers Report 2017,” an annual study of the industry published by the consulting firm Wohlers Associates.

Printers that sell for under $5,000, a market dominated by extrusion technology, are the fastest growing segment. Sales of such machines hit $464 million in 2016, a 50% increase from the year before and a nearly 12-fold increase from 2012, according to the consulting firm. Sales of polymer filaments and other materials for FFF hit $182 million last year.

Of the various 3-D-printing technologies, extrusion is also the most popular in terms of the number of machines sold worldwide, says Terry Wohlers, president of Wohlers Associates. This popularity is largely due to affordability. The average selling price for the machines in this category is just short of $1,100, according to “Wohlers Report 2017.” XYZprinting, a Taiwanese firm, even makes a machine that sells for under $300.

The average price of printers that sell for over $5,000—a category that includes laser sintering, stereolithography, and high-end extrusion machines—is more than $100,000.

Wohlers says some in the industry had hoped consumers would embrace the low-cost machines, but that hasn’t happened except for dedicated hobbyists and engineering students. “Most of the low-cost desktop machines are going to companies and educational institutions,” he says; companies use them primarily for concept modeling as well as prototyping and tooling.

The Autoeuropa factory isn’t the only example of shop-floor 3-D-printing use. Just last month, the document printer company Ricoh said its plant in Miyagi, Japan, will use extrusion machines from Stratasys to make fixtures out of ABS instead of relying on machine shops for metal tools. Ricoh says it once required an extensive inventory of tools and fixtures to accommodate frequent production changes, but 3-D printing now allows it to make tools as needed.

Until recently, polymer companies were mostly indifferent to the market, figuring that the volumes weren’t worth their attention. Producers of 3-D-printing equipment and filament were largely on their own, forced to make do with resin intended for processes such as injection molding.

Today, polymer makers are more interested. Even if the market isn’t enormous, they say 3-D printing will at least complement their existing engineering polymer businesses. Their strategy is to apply their materials science know-how to make an improved slate of 3-D-printing polymers that engineers will flock to.

Extrusion 3-D printing offers plenty of materials science challenges. For example, the quality of 3-D-printed parts isn’t quite on par with what pops out of an injection-molding machine.

Jared Nelson has been looking into this issue. The engineering professor studies the properties of 3-D-printed parts at the Hudson Valley Advanced Manufacturing Center (HVAMC) at the State University of New York at New Paltz. The center is the site of a 3-D-printing “super-lab” set up in collaboration with printer maker Stratasys.

“We do see a decrease in strength and stiffness from an injection-molded piece to a 3-D-printed piece,” Nelson says.

Laying down round strands of filament next to and on top of each other results in air gaps, which weaken the overall part. “It is like your fingers,” he says. “They don’t perfectly line up.” Injection molding, in which molten plastic is shot into a mold at high pressure, doesn’t have this problem.

Moreover, some materials lend themselves to 3-D printing better than others. For example, Thomas Martzall, founder of the printing filament firm Taulman3D, says nylon 6,6 cracks when you try to wind a 1.75-mm-diameter filament onto a spool. And some polymers don’t have sufficient melt strength for 3-D printing. Filaments made from them fall apart when heated.

Daniel Freedman, dean of the School of Science & Engineering at SUNY New Paltz and director of HVAMC, says ABS can be tricky to print. It shrinks when it cools and curls along the edges of parts. Freedman says it’s best used in a high-end machine with a heated chamber. “Avoid doing it on a desktop,” he advises.

One material that has taken naturally to 3-D printing is the corn-derived polymer polylactic acid (PLA). Much of PLA’s conventional sales come from packaging and disposable cutlery.

Around 2011, NatureWorks, the world’s largest producer of PLA, started getting requests from companies seeking to use it for 3-D printing filament. Dan Sawyer, who leads new business for NatureWorks, says the company didn’t know what to make of the inquiries from the tiny market. NatureWorks sells resin in 750-kg boxes. Company officials figured it would take months for these customers to use that up.

“We were not necessarily all that enthused about it and, at the time, didn’t have an appreciation for what our material would bring,” Sawyer recalls.

Yet business in 3-D printing took off when it turned out that PLA brings a lot. The material has low shrinkage, unlike ABS, and good adhesion between printed layers. Additionally, its low melting point means the extrusion nozzle doesn’t have to get too hot to soften the material. It also has low odor. A strong burning-plastic smell is an often-heard complaint about ABS.

These factors make PLA ideal for affordable desktop printers that don’t have heated chambers. Such printers are found in high school and college engineering courses. Some popular printers, like the MakerBot or certain models from XYZprinting, are designed to process only PLA. The resin’s share of the desktop printer market is more than 75%, Sawyer says.

NatureWorks also sells in commercial markets. Industrial jig and fixture applications, such as at the Volkswagen plant, are big ones.

And PLA is taking off in investment casting. In this process, the polymer is used to print out patterns for complex metal parts such as turbine blades and valves. The PLA version of the part is coated with ceramic and burned out. Workers pour molten metal into the cavity to make the final cast. PLA, Sawyer says, leaves little residue when burned. It’s also quicker to 3-D print PLA than to carve wax or wood into a pattern.

But PLA has its limitations. It’s hard yet famously brittle. PLA’s low melting point, which makes it easy to print, also means it isn’t terrific for parts that are exposed to heat. As New Paltz’s Freedman points out, a PLA part will warp in a hot car on a summer day.

Sawyer acknowledges that industrial customers requiring impact and temperature performance generally have been upgrading to engineering resins such as ABS. NatureWorks’ response, he says, is grades of PLA tailored for 3-D printing with properties that can rival those of ABS.

To get better impact resistance, the company added an impact modifier. To improve high-temperature performance, it increased the resin’s crystallinity by adjusting levels of the lactide isomers used to make the polymer. An even mixture of l- and d-lactide results in a relatively amorphous polymer. Increasing one of the two monomers makes it more readily crystallize. Crystalline parts can match or exceed the thermal performance of ABS, Sawyer says.

SABIC is another firm that entered 3-D printing because of demand for its materials, which include ABS and polyether imide (PEI). The company has collaborated on 3-D-printing initiatives such as Big Area Additive Manufacturing, from the 3-D-printing technology firm Cincinnati Inc., which makes large objects such as boat hulls and car chassis.

“We believe our involvement as a consumables supplier to the additive manufacturing industry can help advance additive manufacturing from a prototyping technology to a viable mass production process,” says Stephanie Gathman, SABIC’s director of emerging applications.

Earlier this year, the company launched ABS, polycarbonate, and PEI filaments optimized for use in Stratasys extrusion printers. The polycarbonate product offers higher-temperature performance than that of ABS. Experts say PEI boasts the best heat and strength properties in materials available for 3-D printing. Airbus is even allowing PEI to be used in 3-D-printed nonstructural parts for the A350 XWB aircraft.

Gathman says 3-D printing could become a significant business for SABIC. “The volume of materials will continue to grow as the industry sees broader adoption of additive manufacturing processes, not just for prototyping, but also as a viable industry manufacturing technology capable of enabling mass customization and the printing of fully integrated functional items,” she says.

To meet the demands of the industrial 3-D-printing market, some firms are trying to introduce polymers that haven’t been used before. Such materials are the specialty of the filament supplier Taulman3D.

Around 2012, founder Martzall realized that choices for 3-D printing were lacking. PLA is hard but brittle. ABS has issues with adhesion between the layers, which presents a delamination problem for large parts under stress. “I decided that there was nothing out there that would bring in the industrial customer,” he says.

At the time, people were resorting to using nylon weed-whacker line as a filament. “They could get a few prints out of it,” Martzall says. “What they didn’t realize was that they were damaging their machines.” Weed-whacker line contains a lot of mineral fillers, deposits of which clog printer nozzles and cause the machines to overheat.

Working with a chemical company—Martzall won’t say which one—Taulman3D developed a series of nylon filaments, including its highest-end product, Alloy 910. “Alloy 910 is very hard,” he says. “It is almost as hard as PLA, but you can hit it with a sledgehammer.” Alloy 910’s properties are nearly as good in 3-D printing as they are in injection molding, he claims.

With products like these, Martzall says, engineers can do more than merely examine the form of parts and how they fit together. They can really test function. If the part is a bracket for holding a motor in place, they can run the motor to see how the part performs.

Martzall also sees applications in finished goods. For instance, companies that do just-in-time manufacturing, used to minimize inventories of components and raw materials, sometimes opt to print parts if they run out of stock. He also sees demand for the materials to make parts when the ones made by the original manufacturer are no longer available. In these situations, printing is an alternative to machining parts from large, plastic blocks.

Taulman3D has been collaborating with chemical companies on additional materials. It has released filaments based on polyester copolymers (one using a copolymer from Eastman Chemical), which are tough and offer attractive aesthetics. It has also launched a product based on DuPont’s Surlyn ethylene ionomer, a clear polymer that is normally used in packaging and golf ball covers. Martzall is getting requests for it for 3-D-printed medical prostheses.

A much larger company, BASF, is taking a similar approach to 3-D printing. The German chemical giant, a major producer of engineering polymers, annouced a new business, BASF 3D Printing Solutions, in July. A few weeks later, the company bought Innofil3D, a Dutch maker of PLA, ABS, and polyester filament.

“BASF has continuously been monitoring the rising market for 3-D printing for many years,” says Dirk Simon, director of 3-D printing for BASF New Business. “Due to our close collaboration with original equipment manufacturers, for example in the automotive sector, we know that many customers are very interested in applying the new technology for industrial-scale processes.”

Simon points out that stereolithography, which allows for high-definition printing of small parts, has been a disruptive force in the manufacture of custom hearing aids and dental aligners. He doesn’t expect 3-D printing will be suitable for large-scale production of finished goods within the next 10 years. But like Martzall, he has already noticed spare parts and other small-scale products being 3-D printed.

“The future adoption of the technology will depend on whether the industry can make 3-D-printed products more affordable,” he says. “Therefore, the focus will be on reducing material and equipment costs, increasing throughput, and improving quality.”

BASF intends to work with universities and customers toward these ends. The company boasts that it has “the broadest portfolio of materials that can be developed for 3-D printing.” The company makes nylon, polyethylene terephthalate, polybutylene terephthalate, and polyacetal. It also has polyurethanes, functional additives, pigments, and stabilizers that it intends to use in 3-D materials.

Trinseo’s strategy is nearly the opposite. It has no desire to make 3-D printing a stand-alone business.

This summer, the styrenic polymers company formed a collaboration with Advanc3D Materials, which now offers filaments made from Trinseo’s ABS and polycarbonate-ABS blends. Philippe Belot, business director of performance plastics for consumer essential markets at Trinseo, says the resins are no different than the firm’s injection-molding grades.

One reason is that Trinseo’s ABS polymerization process makes a high-purity product that is already ideal for 3-D printing and doesn’t have to be further modified, Belot says.

More importantly, Trinseo, as part of its business plan, actually wants resins for 3-D printing and injection molding to be exactly the same. For example, one of Advanc3D Materials’ new filaments is made from a popular medical grade of ABS. The resin has been used for decades in injection molding to make products like handheld devices and inhalers.

Belot doesn’t see 3-D printing challenging injection molding in large-scale production, such as making tens of thousands of inhalers or automotive air vent covers. Injection molding, which churns out parts in seconds, is better at that kind of job.

And Trinseo’s real business is resin for injection-molded parts. It hopes that an engineer working with a Trinseo resin in a 3-D-printed prototype will specify that same resin for mass production.

For Trinseo, 3-D printing is more of a technical service. “Our goal is not to spread the market with resin,” Belot says. “To be honest, the total market potential will be very limited. For us, it is peanuts.”

Although polymer companies differ on how important 3-D printing will become, most agree that the technology won’t get far on the factory floor without their materials science expertise. “Finding the right materials that can provide the right performance will definitely take the involvement of those who understand the materials the best,” NatureWorks’ Sawyer says.

Source: cen.acs.org

×