Essex Furukawa is planning a $60 million investment to add a new manufacturing area for magnet wire to be used in electric and hybrid electric vehicles. Laugle Properties and Dualtech, Inc. are planning a $9.6 million investment to expand into a larger building south of its current facility, which will house a new foundry and machining equipment.

The Franklin City Council approved real and personal property tax abatements for both companies at their May 1 meeting.

Essex Furukawa

The global wiring manufacturer has been in business since 1896 and has operated its Franklin magnet wire plant since 1993. The Atlanta, Ga.-based company also has operations in Fort Wayne and Columbia City, Indiana and seven other countries.

The company has an existing seven-year tax abatement that was approved in March 2021 to facilitate the company’s purchase of $3 million in equipment to start a new product line for magnet wire used in electric vehicles.

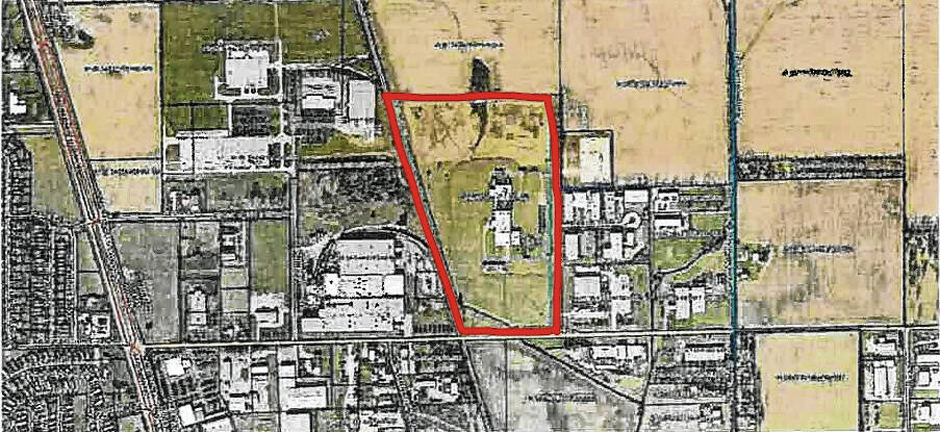

At the time, a company representative said plans were taking shape to make the Franklin facility the home of much of its electric vehicle wiring manufacturing in the United States. That’s because the company has plenty of room to expand on the 41-acre parcel at 3200 Essex Drive.

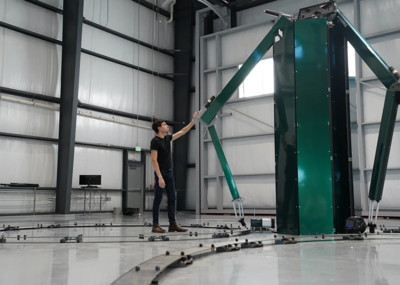

The company was back on May 1 for a tax abatement to facilitate a 60,000-square-foot building expansion. The $30 million addition will nearly double the size of the current 68,0000-square-foot building and will grow the facility’s manufacturing capacity for EV and HEV magnet wire. The company is also investing $30 million in equipment, according to the abatement application.

The company is growing this product line fast and adjusting to customer needs, said Lindsay Hartman, Essex Furukawa’s U.S. marketing director.

“We make custom products that fit individual company’s needs. So, as innovation hits this industry, as they design new cars and new engines, new modes of transportation, we’re able to adjust with that as quickly as our company and our customers do,” Hartman said. “And that’s what we’re doing here in Johnson County.”

The company expects to triple its investment in EV and HEV magnet wire production in the U.S. in the next seven years. The Franklin facility is poised to be part of that expansion, she said.

The project will also include an employee lounge, a maintenance shop expansion and additional parking, Hartman said.

“We have a great facility here and they… are consistently recognized for their quality and for the incredible work that they do,” Hartman said. “We want to make sure that they have the best equipment and support that we can provide for them.”

For the real property abatement, the company will save $4.02 million, while paying $4.9 million in taxes over a period of 10 years. For the personal property abatement, the company will save $3.3 million, while paying $2.9 million over a period of seven years, according to tax estimates compiled for the city.

The amount of taxes paid yearly will increase each year of the abatement until full taxes are paid at the end of the abatement period. With the expansion, $14.4 million more in taxes will be paid to the city over the next 20 years, without the investment the city would get $1.5 million, tax estimates show.

The expansion will also add 10 to 15 new jobs and retain 88 existing employees. New jobs will be technical, precision production and equipment operator positions at an average wage of $23 per hour.

The company will also pay economic development fees to the city for both investments. The fees fund grants that nonprofit organizations in the city may apply for each year.

Dualtech

Formed in 2002, Franklin-based Dualtech has expanded multiple times and doubled its workforce in the last 10 years. The company creates complex prototypes and castings for some of the largest companies in the U.S., including Cummins and Caterpillar.

Dualtech, along with Innovative Casting Technologies and Innovative 3D Manufacturing, are a group of Franklin manufacturing companies owned by the Laugle family.

The new $4.4 million building is expected to start construction in August with completion expected in March 2024. It would be filled with $5.2 million in equipment to outfit a new foundry and machining shop in response to business growth, the abatement application says.

The company received tax abatements for two initial investments and to rebuild after a fire at the foundry, however, the company has not requested another abatement since 2008. The company completed expansions in 2009, 2013, 2016 and 2018, purchased land, and bought several expensive pieces of equipment without an abatement from the city, said Dustin Huddleston, an attorney for the company.

“They’ve had expansion without requesting abatements in the past. They’re a local company that is well-renowned throughout the world. A lot of national and international companies rely on their products because they build their products with high quality,” Huddleston said. “The competition is foundries over in China who don’t build products as well and tend to fail. So, companies look to the Laugles to produce high-quality components.”

The expansion will grow the company’s capacity by adding another foundry, allowing Dualtech to keep up with their customers’ demand, Huddleston said.

“They want to sustain this for the future. This is a real critical pivoting point for them. They want to use this to be competitive in the market,” he said. “A second foundry will allow them to keep up with the demand for their highly sought-after product.”

The expansion will also add 11 new jobs and retain 50 existing employees. New jobs will be service, precision production and equipment operator positions at an average wage of $27 per hour.

The council, at the recommendation of the Franklin Economic Development Commission, awarded a 10-year abatement for both real and personal property. This is an exception to the rule, as the commission typically gives 5-7 year abatements for personal property.

The council also allowed an exemption on paying economic development fees because of how much the company already gives back to the community. Huddleston said the company donates to a wide variety of organizations including Franklin Education Connection, Johnson Memorial Health Foundation, Franklin College, Franklin Community Schools and youth sports. The family is also working to establish an endowed fund with the Johnson County Community Foundation.

Mayor Steve Barnett and Council member Shawn Taylor, who represents the council on the EDC, both said they support making these exceptions for the Laugle family.

”It is a little bit out of the norm for us, but just because of what the Laugle family has done for the city of Franklin (we support it). It’s a local company and, you know, they give back to the city time and time again,” Taylor said. “So, we didn’t have any problems with the EDC fees or going on with the 10 and 10 on this project alone.”

For the real property abatement, the company will save $590,177, while paying $730,723 in taxes over a period of 10 years. For the personal property abatement, the company will save $307,501, while paying $245,600 over a period of 10 years, according to tax estimates compiled for the city.

The amount of taxes paid will increase each year of the abatement until full taxes are paid at the end of the abatement period, tax estimates show.