2020 has been rough for industries all over the world. Even the automotive industry could not escape the unique challenges stemming from pandemic-induced lockdowns, the economic slump and subdued consumer confidence, all of which have caused car sales to nosedive globally.

But despite the overwhelmingly bearish sentiment, electric vehicles (EVs) have remained a distinct silver lining, with European EV sales bucking the overall market decline, thanks mainly to government regulations.

The European Union last year began enforcing an emissions standard of no more than 95 grammes of carbon dioxide per kilometre travelled for passenger cars, with 100% compliance mandated in 2021. This drove new EV sales, as did an increase in EV purchase subsidies by Germany in February. Incentives introduced in Italy in 2019 also started to spur the market.

In China, the EV market decline bottomed out in February, with sales falling 60% year-on-year to 16,000 vehicles. However, volume rebounded strongly in April to around 80% of the year-ago level. Indeed, electric cars have experienced impressive adoption over the last decade, with sales expanding every year by at least 60% -- except in 2019, when China introduced regulations to deter too many new manufacturers from entering an overcrowded market and cut EV purchase subsidies by about half.

Another boost to the EV market has come from a reversal in the strategy of Toyota Motor. The world's second-largest automaker, which has long championed hydrogen fuel cell technology, is now preparing to join other manufacturers that are offering bespoke EVs in Europe and North America. Toyota's solid-state battery, which provides more than 480 kilometres of range on a 10-minute charge, is expected to be a game-changer when it is launched later this year.

Toyota aims for global sales of 5.5 million EVs annually by 2025, Koji Toyoshima, deputy chief officer of its ZEV Factory, told a presentation for the European market. Over the next five years, it aims to launch 60 new EV models including hybrid electric vehicles (HEV), plug-in hybrids (PHEV), BEV (battery electric vehicles) and hydrogen fuel-cell electric vehicles (FCEV).

Mr Toyoshima said Toyota was also working on a mass-produced EV using a solid-state battery pack. Offered in the same size as a traditional lithium-ion battery, it might arrive earlier than the company's original target date of 2025.

"We have been preparing for this for some time, with a focus spanning across the entire powertrain (HEV, PHEV, BEV and FCEV)," a senior executive of Toyota's Thai unit told Asia Focus, adding that the Japanese automaker would introduce an EV in the Thai market by 2023.

Toyota Motor Thailand (TMT) is investing 19 billion baht to manufacture EVs at its Chachoengsao plant. It is among five HEV projects that have received incentives from the Board of Investment (BoI), with combined production of 352,500 units a year.

The executive said Toyota's EV strategy was being driven partly by the Japanese government's drive to achieve net-zero greenhouse gas emissions by 2050, through manufacturing and running cars on renewables only. Automobiles account for nearly 20% of CO2 emissions in Japan.

Krisda Utamote, president of the Electric Vehicle Association of Thailand (EVAT), said that like most manufacturers, Toyota has been developing technologies on all four categories instead of focusing on one electric platform, in order to meet corporate fuel economy targets.

"In my view, major investments in electric vehicles by key automotive companies will help boost the electrified vehicle market in the near future," he told Asia Focus.

Each country, he says, has its own electrification strategy. "In Japan, we now see that the government is encouraging all new car sales to be eco-friendly and potentially to go entirely for zero-emission vehicles by 2030," he said.

The Japanese government currently requires carmakers to improve fuel efficiency by 30% by the end of 2030. "In Japan, where automakers like Toyota have a well-established hybrid technology as a main drivetrain of their eco-friendly strategies, HEV will be considered as eco-friendly vehicles, similar to PHEV and BEV, with the government's support," he said.

"With the current and future vision of major Japanese original equipment manufacturers (Toyota, Nissan and Honda) and the R&D direction toward EVs, we believe it will create huge momentum for EVs among global new car sales," commented Narain Chutijirawong, clients and industries director with Deloitte Thailand.

"With more OEMs joining the EV market, it will sooner or later achieve economies of scale that will help to achieve more affordable EVs. Then the existing price premium associated with EVs will be consigned, and this will drive EVs to mass-market adoption," he told Asia Focus.

Mr Krisda, who is also director of corporate communications at BMW Group Thailand, acknowledged that Toyota's solid-state battery would be a major breakthrough.

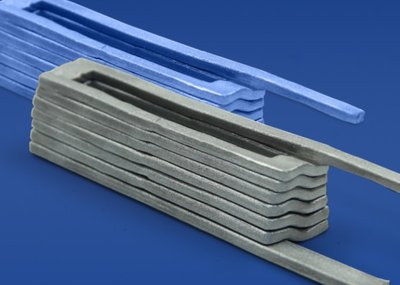

"Solid-state battery technology has a high-capacity energy storage device that improves on today's lithium-ion batteries," he said, explaining that it replaces the liquid or gel-form electrolyte with a solid, conductive material.

"Solid-state batteries are available in small sizes as compared to liquid lithium-ion batteries. Due to the absence of flammable materials, solid-state batteries will help strengthen operational safety."

ROSY OUTLOOK

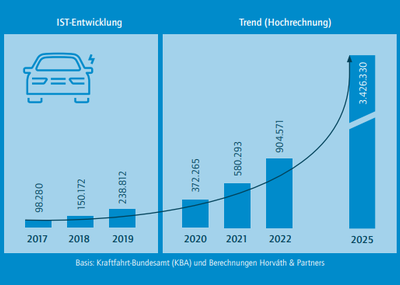

Sales of EVs grew 6% in 2019 to top 2.1 million globally, lifting the total stock to 7.2 million, 47% of which were in China. EVs accounted for 2.6% of global car sales in 2019, as technology for electrifying two- and three-wheelers, buses and trucks advanced.

Ambitious policy announcements have been critical in stimulating EV rollouts. A continuing shift from direct subsidies to regulatory and other structural measures -- including zero-emission mandates and fuel economy standards -- have set clear, long-term signals to the industry and will be more economically sustainable for governments.

China and Europe have national and local subsidy schemes in place but have also strengthened and extended their New Energy Vehicle mandate and CO2 emissions standards, respectively. China recently extended its subsidy scheme until 2022.

Experts say that in light of the Covid pandemic, urban public transit will face challenges of providing affordable services while ensuring health security. Thus, more commuters may turn to personal vehicles if they have any health concerns.

However, in dense cities, buses are a key means of transport that is not easily substitutable by cars without worsening congestion. Hence, electric buses will get a boost with continued government support.

According to Mr Krisda, Deloitte estimated sales of 2.5 million in 2020 for all kinds of EVs (xEVs). The number is expected to reach 11.2 million in 2025 before hitting 31.2 million in 2030, representing 32% of new-car sales worldwide. The majority of those sales will come from China, which will account for 49%, followed by 27% in Europe and 14% in the Americas.

"The Chinese government has introduced a lot of supports for EV manufacturing. Basically, the country has to fight against air pollution so the EV is one of the solutions it has to promote," he said.

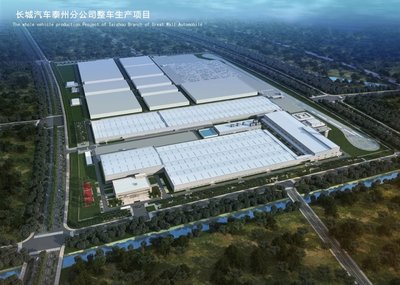

China has built up considerable infrastructure and supported local manufacturers to develop EV models, among them BYD, Great Wall Motors (GWM) and MG.

The Beijing government also welcomed investment from abroad in the sector, notably by US-based Tesla, giving the market a further confidence boost.

"Another scheme that makes the Chinese market very successful is the recent announcement that if the BEV price is below 300,000 yuan (1.38 million baht), buyers will have the incentive of a cash rebate to make it even easier for Chinese buyers to own BEVs," said Mr Krisada, noting that sales of Tesla in China jumped from 2,000 to over 10,000 units in just one month after the policy was announced.

Deloitte points to several factors supporting EVs, including reduced concerns about production costs globally (except China); prices already reaching parity with traditional internal combustion-engine vehicles, after accounting for subsidies and the total cost of ownership; comparable driving ranges between electric vehicles and their traditional peers; electric cars being a crucial step toward achieving climate-change goals; and firm commitments by legacy carmakers to start producing electric vehicles.

Apart from Toyota, other brands have announced clear EV strategies. General Motors (GM) aims to raise its spending on electric and autonomous vehicles to $20 billion by 2025. It plans to launch 20 new electric models by 2023 and sell 1 million battery cars per year in the US and China by the middle of the next decade.

The automaker says its cars will have longer range, faster recharging and greater profitability, with battery technology reportedly bringing costs below $100 per kilowatt-hour.

Volkswagen, the world's biggest automaker by unit volume, is strengthening its EV portfolio in China, pledging to invest €15 billion ($18 billion) over the next five years to achieve its long-term carbon-neutral goals.

The Japanese truck manufacturer Hino Motors and the Chinese EV maker BYD Auto Industry will set up a 50-50 joint venture in China this year to develop electric trucks and buses, as well as EV components, for the Asian market. The move represents a broader push into next-generation energy sources by Hino, a Toyota affiliate that also has a tie-up with the Volkswagen truck and bus unit Traton.

New electric commercial vehicles will be released in Asian markets in the first half of the 2020s under the Hino brand. Earlier, Hino and Toyota announced plans to develop a prototype hydrogen-powered truck for the North American by 2024.

Mitsubishi Motors, which plans to add five or more mainly electric and plug-in hybrid vehicles to its lineup starting from December 2020, looks to roll out a hybrid version of its Xpander minivan, a hot seller in Southeast Asia, as early as fiscal 2023. It aims to have EVs account for half of its global sales in 2030, up from 7% now.

Mitsubishi will tap partnerships to expand its lineup of electrified models. In China, the company and Guangzhou Automobile Group will release a jointly developed EV in fiscal 2021. Mitsubishi plans to develop a mini-EV with Nissan Motor, part of a three-way alliance with France's Renault.

ASEAN PUSH

Southeast Asian policymakers are racing to accelerate the adoption of EVs as a step to becoming a regional manufacturing hub.

Before the pandemic, the Indonesian government set an ambitious target of 20% of vehicle production to comprise electric and hybrid vehicles by 2025. An abundance of natural resources such as cobalt, zinc and manganese -- raw materials for EV batteries -- is seen as a key strength in attracting EV sector investment.

Hyundai Motors has said it is exploring the production of "Asean-specific electric vehicles" in its Indonesian plant, adding that it "is committed to helping nurture Indonesia's EV ecosystem".

According to media reports, the South Korean group has also confirmed that it would build a new vehicle assembly plant in Indonesia, with the first phase to be completed toward the end of 2021.

Toyota, meanwhile, announced in late November the launch of a Lexus EV model in Indonesia, the first EV the Japanese manufacturer is selling in Southeast Asia.

The Jakarta government has reduced taxes on low-emission vehicles and plans to gradually replace government fleets with electric models. It is also pushing for more charging stations. There were just 14 last year in the country but it aims to build 150 this year and over 1,500 by 2024.

In Thailand, the BoI in November approved incentives covering all major aspects of EV supply chain, with a focus on BEVs and local production of critical parts. The new promotions, which replace a package that expired in 2018, cover passenger cars, buses, trucks, motorcycles, tricycles and ships.

So far, the BoI has approved 26 projects for EVs of various types, including five HEV, six PHEV, 13 BEV and two E-Bus projects, with a combined production capacity of over 566,000 units per year.

China's GWM acquired the Thai plant of GM last year. The Rayong facility is being renovated with a target to start rolling out EVs in the first quarter of this year.

"GWM has been researching and getting to know Thai consumers better by letting top management and department heads go to listen to Thai consumer voices in Bangkok and key provinces regionally," Zhang Jiaming, GWM's president for Asean, told Asia Focus by email.

"The focus is on what they need in a car, what pain points they encounter when buying a car and getting a car serviced, and others. We will use these consumer voices to shape our business strategy to serve Thai customers better.

"At least we hope to see growth (of car sales) from 2020. For 2021, our core objective is not about sales. Our priority is to build up our brand."