EBITDA AT €480.0 MILLION (+8.2%), EBIT AT €346.3 MILLION (+5.7%),

NET PROFIT: €263.4 MILLION (+9.5%).

DIVIDEND OF €0.22 PER SHARE

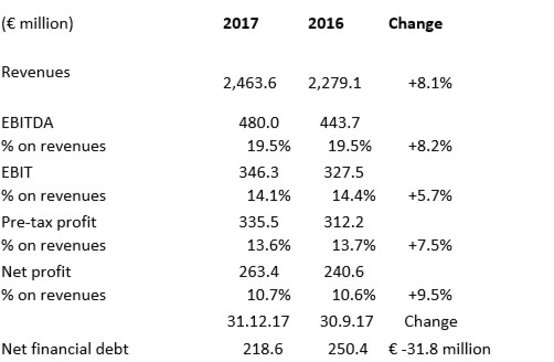

Compared to 2016 results:

• Revenues grew by 8.1% to €2,463.6 million (+9.0% on a like-for-like exchange rate basis)

• Good growth of margins:EBITDA +8.2% to €480.0 million; EBIT +5.7% to €346.3 million

• Net profit grew by 9.5% to €263.4 million

• Net investments amounted to €356.2 million

• Net financial debt at €218.6 million

• Proposal to distribute an ordinary dividend of €0.22 per share

Results at 31 December 2017:

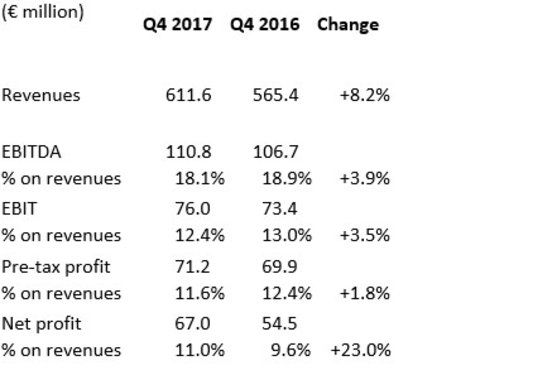

Q4 2017 results:

Chairman Alberto Bombassei stated: "In 2017, Brembo clearly demonstrated its ability to swiftly exploit the new strategic investments in countries identified as priorities in pursuit of continuing growth and development of products in collaboration with our customers. At the same time, constant innovation of existing plants and processes continued and our product portfolio expanded further, driven by our constant focus on cutting-edge research and its actual application to materials and braking systems capable of meeting - and often anticipating - the needs of an automotive market in the midst of a rapid transformation. I also believe that it is now finally possible - on the strength of the long series of positive signs that continued during the reporting year - to consider the resumption of growth in the South American markets on which Brembo operates to have gained greater stability."

Executive Deputy Chairman Matteo Tiraboschi stated: "I feel it is especially important to draw attention to Brembo's very positive performances, also in light of its considerable investments, which in 2017 reached an all-time record level. The Group will see a new cycle of investments brought to conclusion in 2018, and in particular the completion of the plants announced in Mexico, Poland and China, which will gradually become operational over the course of the year. This is yet further proof of the solidity of our core business. We are also satisfied with the further reduction of our net financial position compared to the figure at 30 September 2017, despite significant investments. This is proof of the Group's ability to self-finance."

Results at 31 December 2017

Brembo S.p.A.'s Board of Directors, chaired by Alberto Bombassei, met today and approved the Group's annual results at 31 December 2017.

Brembo Group's net consolidated revenues amounted to €2,463.6 million, up 8.1% compared to 2016 (+9.0% on a like-for-like exchange rate basis). On a like-for-like exchange rate and consolidation basis - excluding the contribution of Asimco Meilian Braking Systems (Langfang) Co. Ltd, consolidated as of 1 May 2016 - the Group's revenues rose by 7.9%.

All the segments in which the Group operates grew in 2017: the car applications sector closed the year with an 8.9% increase compared to 2016. Growth was also reported by motorbike applications (+10.6%) and the racing sector (+6.2%).The commercial vehicles sector remained virtually stable at +0.7%.

At geographical level, Germany - Brembo's second largest reference market with 23.0% of sales-showed a7.1% increase compared to 2016; Italy grew by 12.7%, the United Kingdom by 2.1%, while France decreased by 11.6%.

Sales in North America (USA, Canada and Mexico) - Brembo's top market accounting for 25.3% of total sales - reported a 2.5% decrease, chiefly due to the depreciation of the dollar. Net of that effect, the year-on-year change was -0.8%.

South America (Argentina and Brazil) increased by 17.6%.

The main Asian markets performed very well, with China up 34.2% (on a like-for-like consolidation basis, following the acquisition with effect from 1 May 2016; revenues rose by 23.4%).

A good performance was also reported in India (+27.2%), whereas Japan decreased by 3.6%.

In 2017, the cost of sales and other net operating expenses amounted to €1,560.8 million, with a 63.4% ratio to sales, down in percentage terms compared to 64.0% for the previous year.

Personnel expenses amounted to €436.1 million with a 17.7% ratio to revenues, slightly increasing from the previous year's figure (17.0% in 2016).

Workforce at 31 December 2017 numbered 9,837, an increase of 795 compared to the previous year (9,042). This increase reflects the expansion of the Group's production capacity at the global level.

EBITDA for the year totalled €480.0 million (EBITDA margin: 19.5%), compared to €443.7 million (EBITDA margin: 19.5%) for 2016.

EBIT amounted to €346.3 million (EBIT margin: 14.1%) compared to €327.5 million (EBIT margin: 14.4%) for 2016. Amortisation, depreciation and impairment losses increased by 15.0% to €133.7 million and reflect the large investments made in the previous periods.

Net interest expense amounted to €10.9 million for the year ended 31 December 2017 (€15.4 million in 2016) and consisted of net exchange losses of €1.6 million (net exchange losses of €5.5 million in 2016) and net interest expense of €9.3 million (€9.9 million in the previous year).

Pre-tax profit was €335.5 million, compared to €312.2 million for the previous year. Based on tax rates applicable under current tax regulations, estimated taxes amounted to €67.6 million, with a tax rate of 20.2%, compared to €69.2 million in 2016 (tax rate of 22.2%). Said reduction is chiefly attributable to the lower US taxation.

Net profit for the year amounted to €263.4 million, up 9.5% compared to €240.6 million in 2016.

Net financial debt at 31 December 2017 was €218.6 million, increasing by €22.9 million compared to 31 December 2016 (€195.7 million) and with a €31.8 million reduction compared to 30 September 2017 (€250.4 million).

Results for the Fourth Quarter of 2017

In Q4 2017 alone, consolidated revenues amounted to €611.6 million, up by 8.2% compared to Q4 2016.

EBITDA amounted to €110.8 million (EBITDA margin: 18.1%), up 3.9% compared to Q4 2016. EBIT totalled €76.0 million (EBIT margin: 12.4%), up 3.5% compared to Q4 2016.

The tax rate for the fourth quarter was 3.8%, chiefly due to the adjustment of deferred tax liabilities to the new US federal income tax rate effective from 1 January 2018.

The period ended with a net profit of €67.0 million, up 23.0% compared to the same period of 2016.

Results of the Parent Company Brembo S.p.A.

Revenues of the Parent Company Brembo S.p.A. amounted to €899.1 million for 2017, up 6.6% compared to the previous year.

Net profit was €149.5 million, up 8.0% compared to the previous year.

Approval of Consolidated Statement on Non-Financial Information for 2017

Brembo's Board of Directors examined and approved the results of the Consolidated Statement on Non-Financial Information for 2017 pursuant to Legislative Decree No. 254/2016.

This Statement, drawn up in compliance with the Guidelines of the Global Reporting Initiative (GRI-G4), describes the Group's strategies, the actions implemented and the results achieved in pursuing its sustainable economic growth, while taking account of the expectations of the stakeholders involved and seeking constant improvement of the environmental and social impacts of its activities.

The Consolidated Statement on Non-Financial Information for 2017 will be made available to the public on the Group's website within the terms established by law.

Appointment of the new Manager in charge of the Company's financial reports

At today's meeting the Board of Directors of Brembo S.p.A. passed a resolution appointing Andrea Pazzi, Chief Administration and Finance Officer of Brembo S.p.A., to the position of Manager in charge of the Company's financial reports (Article 154-bis of the Consolidated Law on Finance), formerly entrusted to Matteo Tiraboschi.

The appointment, which was made after receiving the mandatory opinion of the Board of Statutory Auditors and verifying that Andrea Pazzi meets the requirements set forth in Brembo S.p.A.'s By-laws, takes effect for purposes of certifying the financial results of Brembo S.p.A. and of the Group at 31 December 2017. Andrea Pazzi will remain in office until the expiry of the current Board of Directors' term of office, i.e., until the General Shareholders' Meeting approving the Financial Statements for the year ending 31 December 2019.

Calling of General Shareholders' Meeting - 20 April 2018

Today, the Board of Directors has called the General Shareholders' Meeting on 20 April at 10:30 a.m. (CET), at the Company's offices at Viale Europa 2 ,Stezzano (Bergamo).

Among the main items on the agenda, in addition to the approval of the Annual Financial Report, the Board of Directors has resolved to submit the following matters to the forthcoming session of the General Shareholders' Meeting.

1) Proposal for the distribution of profit of the Parent Company Brembo S.p.A.

• A gross ordinary dividend of €0.22 per ordinary share outstanding at ex-coupon date;

• The remaining amount carried forward.

It will also be proposed that dividends should be paid as of 23 May 2018, ex-coupon No. 1 (new ISIN code IT0005252728) on 21 May 2018 (record date: 22 May 2018).

2) Plan for the Buy-back and Sale of Own Shares

Today, the Board of Directors also approved the proposal for a new buy-back plan to be submitted to the forthcoming General Shareholders' Meeting, with the purpose of:

• Undertaking any investments, directly or through intermediaries, including aimed at containing abnormal movements in stock prices, stabilising stock trading and prices, supporting the liquidity of Company's stock on the market, so as to foster the regular conduct of trading beyond normal fluctuations related to market performance, without prejudice in any case to compliance with applicable statutory provisions;

• Carrying out, in accordance with the Company's strategic guidelines, share capital transactions or other transactions which make it necessary or appropriate to swap or transfer share packages through exchange, contribution, or any other available methods;

• Buying back own shares as a medium-/long-term investment.

The proposal envisages that the Board of Directors may purchase, in one or more tranches, up to a maximum of 8,000,000 ordinary shares, at a price of no more than 10% above or below the closing price of the shares during the trading session prior to each transaction, in accordance with applicable legislation.

With reference to the disposal of own shares, the Board of Directors will define, from time to time, the criteria to set the relevant consideration and/or methods, terms and conditions to use own shares in portfolio, taking due account of the realisation methods applied, the price trend of the stock in the period before the transaction and the best interest of the Company.

The authorisation is requested for a period of 18 months from the date of the resolution by the General Shareholders' Meeting and for a maximum amount of €144,000,000, which is adequately covered by the available net reserves recognised in the balance sheet. At present, the Company holds 8,735,000 own shares representing 2.616% of share capital.

Foreseeable Evolution

The data for the first few months of the year confirm a sustainable revenue growth trend.

The manager in charge of the Company's financial reports, Andrea Pazzi, declares, pursuant to paragraph 2 of Article 154-bis of Italy's Consolidated Law on Finance, that the accounting information contained in this press release corresponds to the documented results, books and accounting records.

Annexed hereto are the Statement of Income, Statement of Financial Position and Statement of Cash Flows, which are currently being audited.

Source: Brembo

Partner

Foundry Daily News

Brembo: 2017 Revenues Grew by 8.1% to €2,463.6 Million

Lesedauer: min

[1]