In its third survey since March and April, the BDG has asked its members again about the effects of the corona crisis. In the current survey, key statements from the previous surveys came to a head: In the first survey in March, 76% of the companies surveyed had felt "Coronavirus effects on business operations", 24% had not. In the second survey in April, the denier rate had dropped to 4%, 96% had an impact on the operational process. The value has increased further in the current third survey. In May, 99% of companies notice “effects on the operational process”.

A serious point is lack of orders.

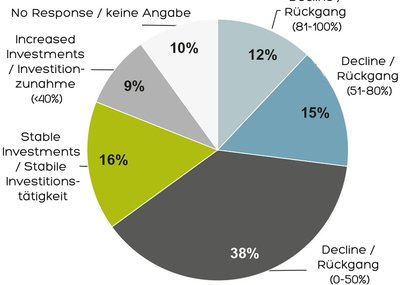

Almost 90% of respondents answered yes to the question of “lost orders or cancellations”, 54% even registered “serious” losses, only 12% “minor”. 81% of the companies surveyed answered yes to the question of "capacity adjustments".

"Short-time work" (77%) and "production stops" (46%) are listed as instruments. After all, 29% of the companies surveyed also cite “downsizing” as the measure currently being examined. "Decisive for the companies in the foundry industry is the planning security of the declining customers," says BDG general manager Max Schumacher. "There must be transparent, partnership-based determinations, the acceptance behavior must not be at the expense of the foundries to be supplied."

When it comes to the current or expected use of loans in the event of liquidity shortages, the industry picture is heterogeneous. Around 52% of the companies surveyed are able to cushion the corona crisis well and see neither current nor prospective liquidity needs through loans. A scarce minority of 44% currently has or is expecting liquidity shortages.

"These include companies that are exposed to a crisis that threatens their very existence," says Schumacher. "The measures decided by the federal government must be implemented in such a way that they arrive quickly and without red tape at the company."

New in the current member survey was the question of the expected time horizon to return to normal utilization. Only a minority of 5% or 8% of the respondents expect a time horizon of 1 to 3 or 3 to 6 months. The majority of companies, at 82%, expect a crisis to last at least six months, including 32%, who expect to last more than a year. The industry expects sales to decline in 2020; Relatively most companies expect sales to fall between 20 and 30%. Therefore, in addition to avoiding additional burdens, effective economic incentives must now be set to enable the German medium-sized economy to restart.

Additional information: The survey took place from 08.05. - 14.05. (Calendar week 20), 93 German foundries took part.

BDG member companies can find the complete evaluation in the BDG extranet under the heading "BDG internal / BDG surveys".