"Thanks to our global presence, reliable supply chains and strong customer focus, we were able to largely offset the negative impact on our business. Our company has shown that it can withstand even difficult market conditions. We are grateful for our customers' trust in our solutions and services. I am very proud and grateful for what our employees have achieved this year. Our company is built on exceptional talent, and we will continue to invest in our culture of lifelong learning to anticipate and shape the future of our industry," adds Stefan Scheiber. He also points out how Bühler has successfully mastered change at the Board of Directors level, ensuring continuity, renewal, and long-term business success as a strong and independent family-owned company.

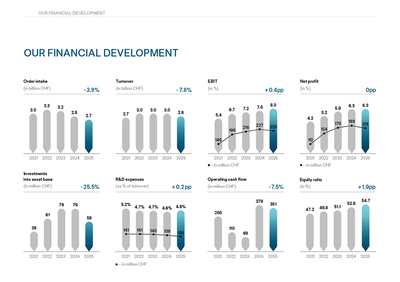

Order intake at Group level remained stable in local currencies, declining only slightly by 0.5% (in Swiss francs, order intake fell by 3.9% to CHF 2.7 billion). Group sales declined by 4.4% in local currencies (a decline of 7.8% to CHF 2.8 billion in Swiss francs), which is attributable to lower order intake in the previous year as well as timing shifts in project execution and delayed material deliveries in some markets. Bühler took decisive action to offset the impact of the revenue trend by consistently leveraging global supply chains, increasing productivity in manufacturing and logistics, and optimising central functions.

Thanks to disciplined cost management, internal productivity and operational excellence, Bühler was able to increase its EBIT margin to 8.0% (previous year: 7.6%) despite lower sales.

Following the exceptional improvement in cash generation in the previous year, net liquidity increased further due to higher operational efficiency, disciplined project management, and a targeted reduction in working capital. ‘Our strong financial position gives us the flexibility to drive our customers' businesses forward through innovation, serve them in more markets worldwide, and support them with extended services throughout the entire life cycle of their equipment,’ says CFO Mark Macus.

Broad business portfolio as a growth engine

Bühler's broad portfolio of solutions and customer services continued to be the basis for its market success in 2025. The Grains & Food division had an encouragingly positive year with stable orders and gained market share in several segments, while the Advanced Materials division maintained its market share but received fewer orders due to subdued market activity. Customer service, a key differentiator for Bühler and a value driver for customers worldwide, increased its share of Group sales for the third consecutive year.

Grains & Food recorded a 1.1% decline in orders to CHF 2,147 million. Within Grains & Food, the Chocolate & Coffee business unit performed exceptionally well, with orders rising 31.0% to CHF 325 million. Value Nutrition achieved double-digit order growth of 12.7%. Orders for Grain Quality & Supply and Consumer Foods declined by 7.4% and 8.8%, respectively. Order intake for Milling Solutions declined by 14.3% compared to a historic high in the previous year.

Advanced Materials recorded a 15.2% decline in orders to CHF 551 million. Business was impacted by weak investment in the automotive industry, uncertainties in Europe and increasing competitive pressure in China.

Die Casting

Die Casting was the most affected, with orders declining by 37.9% as several large megacasting projects were implemented more slowly than expected. Bühler work under the assumption that the drop in the die casting business orders is temporary given the investment climate generally and the capacity situation in the global automotive business. In the long-term Bühler is absolutely optimistic about the potentials of that market and about its own market position.

In die casting there are three hubs in Europe, Asia and North America. Not only in Asie also ín Europa and North America OEMs are pursuing ore actively implementing mega casting projects. So, Bühler’s strategic decision to invest into mega casting possibilities and the technology behind it a couple of years ago has absolutely panned out

The Grinding & Dispersing segment, on the other hand, achieved significant growth of 51.0%, supported by large projects in the battery sector and a revival of activity in inks, coatings and food applications. Leybold Optics recorded an 8.3% decline in orders.

Customer Service: long-term partnerships with customers

Fast, professional and reliable services are an important pillar of Bühler's strategy to help customers grow their business while reducing their environmental footprint. With more than 30,000 active customers using Bühler machines, the installed base is a unique lever for improving yields, energy efficiency and uptime in global food and material value chains. In 2025, customer service increased its share of total sales to 38.3% (previous year: 35.4%). The number of long-term service contracts with customers rose significantly across all business areas and regions, from 2,500 to over 3,000.

Geographical balance brings stability and opportunities

Bühler's global presence and network remained stable, with a few regional shifts. In the USA, orders declined by 31% as customers were unsettled by the tariff issue and postponed their investments in equipment and solutions. The strongest sales growth came from Africa, which became the largest region for Bühler's food and feed business for the first time. The continued strength of the Middle East, Africa and India region – with particularly high growth in Africa and the Middle East – partially offset the weaker performance in America and Asia.

Networking Days 2025 – Multiplying Impact Together

In 2025, Bühler hosted its fourth Networking Days event, bringing together 1,000 leaders from business, science and politics from all continents to discuss how joint action can accelerate progress in the areas of food, feed and mobility. The Networking Days focused on the scientific evaluation of 15 industrial value chains in Bühler's three main industries. The results showed that in eleven of these value chains, it is possible to reduce energy, waste, water and CO₂e emissions by at least 50% by using Bühler technologies that are already available and in use today. With this technology development, Bühler has delivered on its promise to its customers to provide scalable solutions by 2025 that reduce energy, waste and water consumption in their supply chains by 50%. The company has also made further progress in its internal sustainability strategy, reducing its emissions by 30% below the 2019 baseline.

Bühler has once again reinforced its commitment to targeted innovations that improve both performance and sustainability. Research and development expenditure in 2025 amounted to CHF 131 million, representing 4.8% of sales (previous year: 4.6%). The company launched around 60 new products during the year.