- Commission sees automotive as one of the 14 critical ecosystems in the EU.

- Industrial policy should provide the right conditions to boost high-quality jobs and sustainable and safe mobility globally.

- It is crucial to strengthen critical supply chains, but to keep a strong industrial base the EU should also build on existing strengths in areas such as connected and autonomous driving technologies.

- Even if public investment has a strong role to play towards accelerating innovation to deliver the green and digital objectives, the industrial strategy should not overlook the importance of providing the right conditions for private investment and access to scalable markets.

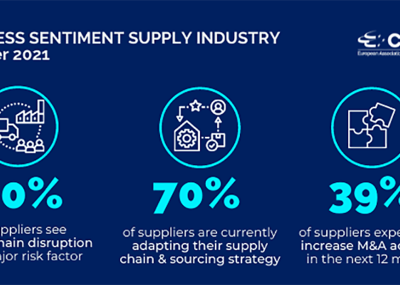

CLEPA welcomes today’s publication of the European Commission’s updated industrial strategy and the announced in-depth review to strengthen the resilience of supply chains in critical areas including raw materials and semiconductor technologies. Europe’s automotive suppliers will be a crucial partner to deliver climate neutrality by 2050 while safeguarding jobs and capitalising on the opportunities of the digital transition. The EU’s new industrial strategy has the potential to provide favourable framework conditions for private investments, enable businesses to diversify sourcing where appropriate, and address undesirable independencies while maintaining the advantages of a global supply chain and access to markets.

Public investment in infrastructure and a framework of Important Projects of Common Interests can co-finance and accelerate private investment in critical technologies that are not yet commercially viable but are necessary to enable the green and digital transition. Nevertheless, private investment will play a leading role and an excessively restrictive definition of green taxonomy and regulatory standards with limited technology openness could make it harder for automotive suppliers to deliver the green transition.

CLEPA Secretary General Sigrid de Vries says: “The Commission identified automotive as one of the 14 critical ecosystems for Europe’s economic and industrial fabric. The relevance of automotive for other industries in Europe is particularly strong. Automotive suppliers directly employ 1.7 million people, on top of the 1.2 million people employed by vehicle manufacturers and create significant employment further down on the supply chain in sectors such as steel, chemicals, and capital goods. The automotive sector can play a crucial role in the continued development of the adjacent European electronics ecosystem. Analysts estimate that under the right conditions, the automotive industry alone could create 400,000 European jobs related to electronic and software components for vehicles.

Advanced driver-assistance systems and innovations to optimise powertrains have increased the value share of electronic and semiconductor systems to 35% of a car’s cost, and are likely to rise to 50% with the continued development of autonomous driving technologies and electrification. The current shortage of semiconductor chips unveils supply chain vulnerabilities, but also brings forward new opportunities for a policy that builds on the global leadership of the EU’s automotive sector to stimulate growth in adjacent sectors—like the semiconductor industry. The automotive industry is accountable for 37% of the demand for European semiconductors, highlighting the importance of our sector to meet the EU’s objective to manufacture up to 20% of all leading-edge semiconductors by 2030.”

In this context, the European Commission identified earlier this year connected and autonomous vehicles (CAVs) as a strategic cluster that offers the EU economy significant potential. The European supply industry holds roughly 60% of all global patents in autonomous driving and an estimated 70% of CAV innovations come from European suppliers. An accommodative policy framework that allows industry to expand its leadership on CAV technologies will result in higher demand for more advanced semiconductor chips and increase the EU’s attractiveness as a location for investment in semiconductor production capacity. Research and Innovation funding along with other forms of public investment could help CAV technologies to make the jump from research labs to the market. Where possible, the European Commission should therefore reassess whether committed budgets to projects such as the Cooperative, connected and automated mobility (CCAM) partnership are sufficiently ambitious.

A successful industrial strategy will be reliant on the long game of supporting R&I investment, standard-setting and improving Europe’s role in artificial intelligence research, skills and a strong research and education ecosystem to develop talent. It is furthermore of critical importance that suppliers keep access to markets to allow the production of fledgling innovative technologies at a global scale and remain open for foreign direct investment. If the right conditions are provided, the automotive sector has the potential to be a global leader of sustainable and safe mobility solutions while serving as an essential bridgehead for the wider European industrial base, and an example of a more sustainable, digital, resilient, and globally competitive economy.

Source: CLEPA European Association of Automotive Suppliers