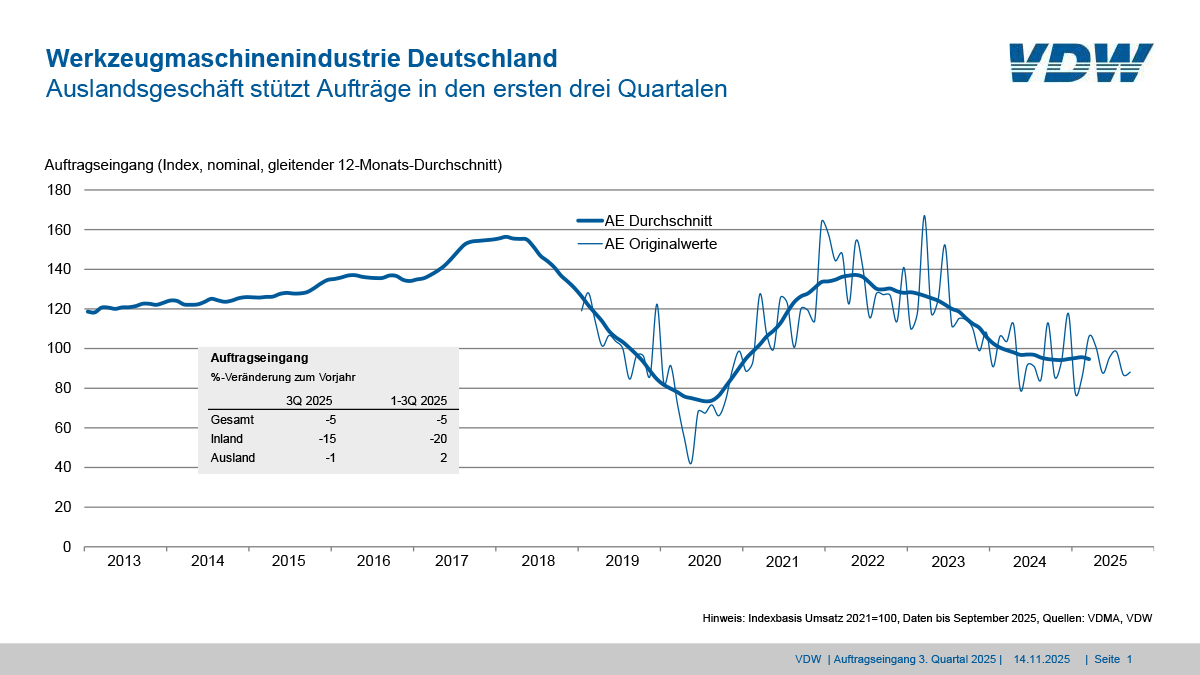

In the third quarter of 2025, order intake in the German machine tool industry fell by 5 percent. Domestic orders declined by 15 percent, while orders from abroad fell slightly by 1 percent. From January to September 2025, order intake also fell by 5 percent. Domestic demand fell by 20 percent, while foreign orders stabilized at plus 2 percent compared to the previous year.

“We assume that the bottom has been reached at a low level, as order intake is currently leveling off,” said Dr. Markus Heering, Managing Director of the VDW (German Machine Tool Builders' Association) in Frankfurt am Main, commenting on the results. Orders, especially from abroad, are currently being supported primarily by automation, digitalization, service, retrofitting, and sustainability. It is mainly customers from the defense industry, aviation, and medical technology who are investing. The former are expanding their capacities due to high demand. This also supports suppliers of electronics, metal and precision components, and mechanical engineering. However, it will be several months before the orders have an impact on production. The important customer sectors of the automotive and supplier industries remain weak.

Regionally, Europe is currently performing well, particularly Turkey, Italy, and Spain, as well as Eastern Europe, led by Czechia, Poland, and Hungary. Other important markets such as China, South Korea, the US, and Mexico, on the other hand, are showing signs of slowing down.

“The continuing uncertainty in the global economy caused by US tariff policy and the very slow pace of reform in this country are still holding back domestic investment,” says Heering. In addition, factors such as structural change in the automotive industry, ongoing competition with Asian manufacturers, and headwinds from the currency side are weighing on demand, as the euro has appreciated against the US dollar and the yen.

In the first nine months of this year, machine tool sales were down 7 percent. It is expected that in the coming year, Europe, and Germany in particular, will be able to develop from an Achilles' heel into a driving force if the announced investments in defense and infrastructure come to fruition.

Background

The German machine tool industry is one of the five largest branches of mechanical engineering. It supplies production technology for metalworking to all branches of industry and contributes significantly to innovation and productivity gains in industry. Due to its absolutely key position in industrial production, its development is an important indicator of the economic dynamics of the entire industry. In 2024, the industry produced machines and services worth around €14.8 billion with an average of around 65,500 employees (companies with more than 50 employees).