MetalMiner welcomes guest contributor Suriya Anjumohan, a lead analyst at Beroe Inc., which specializes in tracking various steel markets and related alloys. Beroe is the premier global provider of customized procurement services specializing in sourcing, supply chain visibility, financial risk analysis and environmental impact to Fortune 500 organizations. With nearly 400 dedicated procurement specialists in 38 domains, across 9 industries, Beroe proactively invests in knowledge assets to build valuable, real-time procurement insight.

This is the final part of his white paper on Brazil’s aluminum foundry industries.

Although there are numerous strategies, with the changing dynamics of the markets these strategies need to be reevaluated in order to minimize the risk involved, especially in the procurement context. When the mitigation strategies looked from a conservative front can be divided into two broader verticals, namely:

• Juggling among the contract options using various price negotiation levers

• Innovation through demand side management (DSM) applications

Price Negotiation Levers

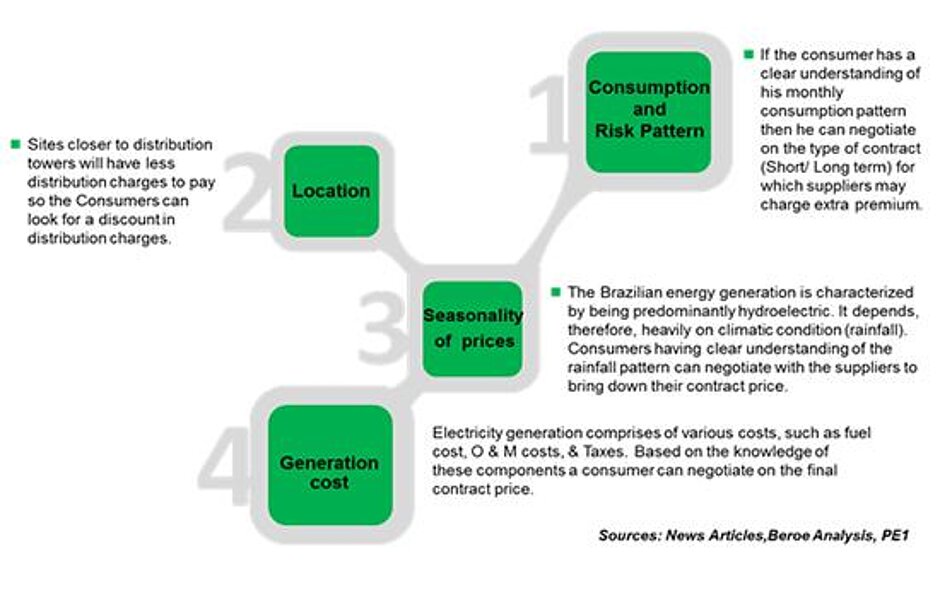

Electricity Consumers in Brazil can negotiate with suppliers on their electricity contract price based on their knowledge of certain parameters of the industry. A clear understanding of their consumption pattern and knowledge about the supplier’s generation mix can give consumers an upper hand over suppliers during the final negotiation of contract prices.

Innovation Through Demand Side Management (DSM)

Demand side management strives to improve the efficiency of energy use, without any reduction in the services that the energy provides. Studies have estimated the electricity savings potential of DSM ranges from 9-38% for a typical commercial building. For an industry such as aluminum castings, which requires energy right from the extraction of its raw material to final product moldings, the opportunities are huge.

As various in-depth studies have found, metal-casters can reduce their energy usage by almost half of what is primarily used for melting and holding aluminum by substituting or upgrading less efficient furnaces. Where there are certain case studies which witness the reduction in gas usage by 50%. This was observed by replacing the old furnace with a new, gas-fired furnace equipped with an advanced insulation package and recuperative burner system and a reduction of about 60% in average operating electric demand and an 18% saving in the average weekly usage was attained by simply retrofitting an existing electric resistance furnace with modern heating elements.

Conclusion

Considering the Brazilian automotive industry, getting into a long-term strategic partnership with aluminum die cast players in Brazil with raised inventory level of aluminum would help in having a secured supply for years to come. To reduce the cost of casting, the automotive players could get into a fixed price agreement with the aluminum die casting players.

Mexico could be a viable option for Brazil’s automotive industry in the procurement of aluminum castings, which could provide an opportunity to experience cost savings for about 5-7%, as Mexico holds a greater advantage toward labor wages and electricity prices which are highly regulated. In the Brazilian context, when looking into the aluminum die casting industry there seems to be lots of potential in the arena of energy saving and overall cost reduction from the energy side.

The only key lies in understanding the applicability of the resources that ar available. DSM being an important resource/tool. Various key players in the sector such as Gibbs andDynacast have already implemented the same and reaped the much higher benefits through reduction in their energy costs by almost 30-40%.

Source: agmetalminer.com