Europe is currently still far from normal due to the corona crisis. The situation has also changed in terms of tool and component prices. In the second half of 2020 there may even be significant cost increases, the causes of which are to be found in the steel market.

After several steelworks in northern Italy had to close down completely at the beginning of the year, steel prices already rose significantly by mid-March. Due to long delivery times and a shrinking supply, a price increase of up to 35% per tonne of steel can be expected in the medium term.

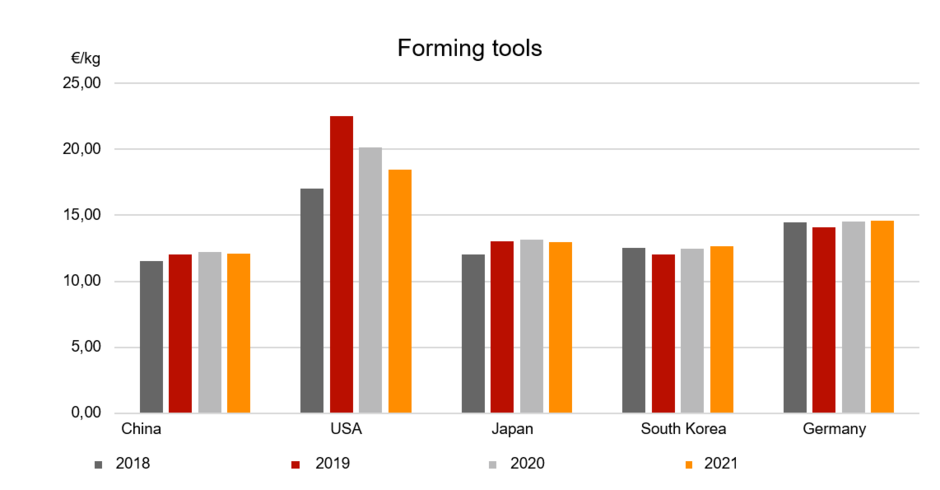

The steel content of tools accounts for less than 10% of their total cost. If the price of steel rises as forecast, tool costs will increase by 2.5%. If the price increase of standard components also made of steel is taken into account, price increases of up to 3.5% can be expected in the second half of 2020. This is a quite considerable increase, if one considers, that prices for forming tools in Germany had fallen by an average of 2.4% between 2018 and 2019.

It is known from tool manufacturers in Europe that their current order situation is still quite meager. This could delay the impending price increase until the fourth quarter. However, this is unlikely to prevent price increases in the long term due to lower supply and higher demand.

The situation is more dramatic in the case of sheet steel components produced with forming tools. Here, a steel price increase would have a direct impact on the price of individual parts. This could increase the calculated unit costs by about 23% - a real challenge for current productions and new ramp-ups!

In order to absorb such an increase in costs in the supply chain, costs and capacities should ideally be agreed or planned for the long term and should also be aligned to a v-shaped recovery in supply. This is the recommendation of Stefan Mangold, specialist for tools at the Schnitzer Group, who among other things is active in cost analysis for forming tools.

This will continue to require a global purchasing strategy to counter regional bottlenecks. A reversal of globalization for specifically manufactured products such as tools would lead to bottlenecks in the short term and is not necessary in the long term", says Mangold.