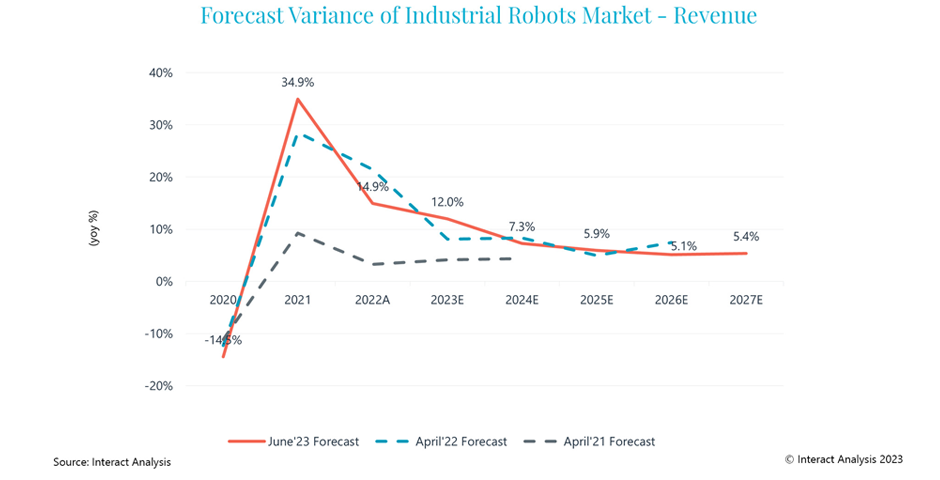

Global economic volatility and supply chain disruptions are having a huge impact on the market for industrial robots, which has led to project delays and decreased spending on automation projects. Despite this, long-term projections remain steady, with electric vehicle (EV) manufacturing and new energy related applications fueling global demand for industrial robots and growth of 5-7% forecast for the sector out to 2027.

Interact Analysis has recently published updated forecasts for the industrial robot market, and they mark the most significant revisions compared to the 2022 version of the report. From 2023 onwards, the market intelligence specialist predicts investment confidence will continue to be low in the short term, causing end-users to delay large capital investments on industrial robotics projects. In the long term, demand from new EV manufacturing lines and from service sectors such as intra-logistics will further fuel the market, resulting in an average growth rate of 5-7% which is much higher than the pre-covid period.

Following a slow 2020 due to the pandemic, the industrial robot market enjoyed substantial growth in 2021, witnessing a year-on-year increase of 34.9%. The market cooled slightly in 2022 but still expanded, registering 11.9% unit shipment and 14.9% revenue growth. The pandemic helped to fuel demand for the robotics industry as companies turn to automation as a way of alleviating labor shortages. Many companies are now investing in industrial automation in order to add stability to their workforce should future crises occur.