In the first quarter of 2018, Rheinmetall Automotive was able to build on its strong showing in 2017. The unit generated sales of €751 million, topping the previous year’s figure – €737 million – by 2%. Adjusted for currency effects, the increase was 5%, significantly outpacing the rate of production growth in the global automobile industry. The number of light vehicles (i.e. under 6t) produced in the first quarter of 2018 declined by 0.7%, though output for the entire year is still expected to grow by 1.9%.

The operating profit rose by €3 million or 5% to €65 million. Accordingly, profitability increased once again to 8.6% in the first quarter of 2018, up from 8.4% a year earlier.

All three divisions succeeded in increasing their sales and earnings, resulting in a slightly better EBIT margin.

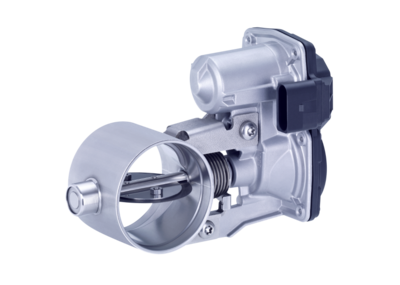

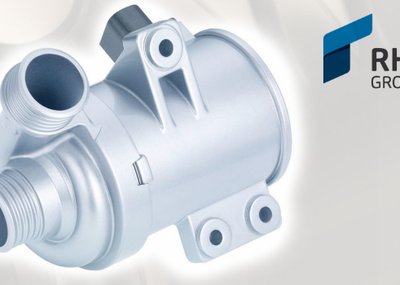

The demand from carmakers for solutions for reduced emissions continues unabated, meaning that sales of the Mechatronics division in the first quarter of 2018 rose slightly to €429 million, an increase of 1%. Operating profit rose from €43 million to €44 million.

At €254 million, Hardparts division sales during the first quarter of 2018 were up by 2% compared to the same period last year. The division’s operating profit improved by 6% to €18 million.

The year got off to an exceptionally successful start for the Aftermarket division. Turnover increased by 11% to €92 million, largely due to sales of the Group’s own Kolbenschmidt and Pierburg brand products. Operating profit was up as well, rising from €7 million last year to €8 million in the first quarter of 2018.

Not included in Automotive’s sales figures, Rheinmetall’s joint venture companies in China once again posted increased revenue in local currency, despite a 3% contraction in the market in the first quarter of 2018.

However, the exchange rate had a distinctly negative impact on earnings. Once the currency effects are taken into account, sales for the first quarter of 2018 remained unchanged from the previous year’s figure at €218 million. Operating profit rose from €16 million last year to €17 million in the first quarter of 2018.

Sales will continue to grow

At Automotive, business trends in major markets in Europe, North and South America and Asia will have a decisive influence on sales. Based on current expert forecasts for automobile production in 2018, which point to a growth rate of around 2%, Rheinmetall expects sales at Automotive to expand by 3% or 4% this year. The guidance is based on the assumption that exchange rates will not change materially from their current level for the remainder of the 2018 financial year. Further improvement in earnings expected for the 2018 financial year Given steady economic growth, Rheinmetall expects to see an absolute improvement in operating profit at Automotive for the 2018 financial year, with an EBIT margin of around 8.5%.