Despite skepticism, global automobility will become more electric in the future. What will become of the German supplier industry for internal combustion engines? Answers are provided by a recent study by the Giesserei-Chemie (IVG) industry association under the direction of Professor Dr. Ing. Stefan Bratzel (CAM). His conclusion: The industry needs a transformation strategy.

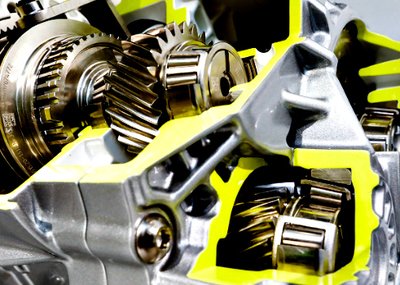

The industrial association Giesserei-Chemie e.V. (IVG) based in Laatzen near Hannover wanted to know in detail: What does the automotive drivetrain technology look like in 2030? The association organizes the leading manufacturers of foundry chemicals in Germany. One main market is the production of internal combustion engines for the automotive industry. If electromobility prevails, this has a significant impact on the future sales opportunities of the companies organized in the association.

Comprehensive Analysis

The IVG commissioned the Center of Automotive Management (CAM) in Bergisch Gladbach with a market assessment for Germany, the European Union, the USA and China. The 165-page scenario analysis comes under the condition of a demanding expansion of the charging infrastructure to the conclusion: "E-mobility will prevail with serious consequences for the automotive industry in general and the IVG associated companies in particular," said study director Professor Dr. Stefan Bratzel, Director of CAM. "Especially for those who mainly deliver parts for vehicles with combustion engines."

After all, in 2030 in Germany almost 30 percent of new registrations will be e-vehicles, which would mean annual sales of about 900,000 cars. In total, around 6 million electric cars will drive on German roads. The production volume for combustion vehicles will fall from 3.2 million vehicles (2016) to only 2.4 million.

"This is not a nightmare scenario for us, but a motivational boost," says Dr. Carsten Kuhlgatz, Chairman of the Industrial Association Foundry Chemistry. "Firstly, the result is that in 2030 there will be over 70 percent more combustion engines. Secondly, electric motors also offer us opportunities." For example, through their further development with the help of castings or solutions for fixing the batteries. Especially as they represent an important safety component, since they are not flammable. "I firmly believe that Germany, as a traditional innovation leader, will do a great job here and take over technology leadership in terms of costs and safety standards," says Kuhlgatz.

Without transformation, no chance of survival

Nevertheless, according to the study's conclusion, it would be advisable for the supplier companies to prepare appropriate adaptation and transformation strategies. Firstly, options for technological enhancement would be conceivable, such as electro-mobility components. Second, industry diversification strategies beyond the auto industry would be an option to broaden the line of action. Thirdly, companies may consider increasing the depth and breadth of the engine-engine sector and thus counting among the consolidation winners.

"In the face of the enormous demands for the implementation of such transformation strategies, companies should not prolong taking action," advises study director Professor Bratzel. After all, there is no doubt that market share and sales volume in the internal combustion engine in Germany are expected to decline significantly. If these developments are also creeping up and only gain momentum at the beginning of the 2020s.

German e-mobility is just beginning

The study provides a solid picture of the actual state of the relevant players (Original Equipment Manufacturer, OEM) and the relevant factors influencing the development of electromobility. It is based on numerous recent studies on the topic and the CAM Innovation Database, in which the vehicle technology innovations of the 19 global car manufacturers with currently 60 brands are systematically inventoried and expanded through regular surveys and background discussions with the relevant industry experts.

The clear result: in Germany, the volume and growth dynamics of e-cars and plug-in hybrids are low. With around 25,000 new registrations in 2016 and a market share of 0.75 percent, the level is low by international standards. The proportion of electric and alternative drives is only 0.6 percent of total production. At the same time, diesel shares in new registrations in Germany and other EU countries are currently in sharp decline. However, if this leads to more new registrations of gasoline engines, the pressure for the sale of electric vehicles will increase for manufacturers to reach the EU's CO2 limits for 2021.

Wishes of potential e-car buyers

Reasons for the low acceptance of e-vehicles are still the low range, the high price and low government funding, the relatively small product range, but especially the poor charging infrastructure. Users want public charging stations where they often park. Basic supply for long-distance traffic is missing, whereby here the weekend and holiday traffics are crucial.

"Therefore, we demand from the Federal Government the rapid and consistent expansion of the charging station network and a standardized payment system for users," said IVG Chairman Dr. Ing. Carsten Kuhlgatz. With sufficient network and charging infrastructure, customers would accept lower ranges. In this regard, the Chinese government is proceeding more consistently.

From a global standpoint

The international comparison also provides groundbreaking insights. The global production of passenger cars and light commercial vehicles under 6 tonnes (LCV) has increased since 2000 from 56 million to 91.6 million (2016). By 2030, CAM forecasts further growth to 116 million. Worldwide, the automotive industry was and is a distinct growth industry.

By far the most important global vehicle markets are still China, the USA and (Western) Europe, and they are also crucial for the strategies of global automobile manufacturers. But while in the medium term in the US and Europe, the market will stagnate, China continues to have further growth potential through 2030. The motorization rates are low, with expected increasing prosperity of the population, and the government makes relatively strict specifications, with the next few years bringing e-car quotas for OEMs and sales stop for combustion. Therefore, China plays a key role in the drive strategies of the future. If battery development is positive and charging station development continues as fast as before, the e-car fleet can grow to up to 114 million vehicles in 2030. In the long term, India also offers considerable future potential.

The analysis of the "Market Development of Electric Vehicles for the Year 2030: Germany, EU, USA and China" provides the foundry industry with valid data for the future route of the automotive industry. "This study impressed me," says study leader Professor Bratzel. "It shows that the industry recognizes the signs of the times and prepares for the future."

The Foundry Industry – A Small Portrait

The companies organized in the IVG generate an annual turnover of 400 million euros in Germany with 1,200 employees. Companies in the IVG include manufacturers of chemical foundry auxiliaries, molding binders and molding compounds. They are an indispensable supplier to the global foundry industry.

The foundry industry, in turn, is one of the most important supplier industries for the vehicle and construction industry, mechanical and plant engineering, building equipment, aerospace, medical technology and the energy industry. There are over 600 foundries in Germany. More than 95 percent of them are medium-sized. From the family business to the corporation, as a manufacturing sector they are an important link for many industries.

80,000 employees work in the foundry industry, including 3,000 trainees

The companies generate 13 billion euros annually and invest 0.5 billion euros per year

5 million tons of cast iron are used year after year: iron, steel, aluminum, copper, zinc and magnesium

5.21 million tons of castings are processed by the German foundry industry as Europe's leader. 35

percent of all products cast in Europe come from Germany. Italy produces 1.96 million tons and France 1.80 million tons

Top 4 in the world - globally, Germany ranks fourth with the volume of cast production

To receive a downloadable PDF of the IVG's "Market Development of Electric Vehicles for the Year 2030: Germany, EU, USA and China" study, please send a request to <link mail internal link in current>info@foundry-planet.com.