There are several different concepts for the drive system of the future. Electric engine? Hybrid drive? Fuel cell? Or the good old combustion engine after all – powered by CO2-neutral e-fuel, i.e. with synthetic fuel produced with the help of renewable energy?

In the long term, electromobility is considered to be the key to CO2-neutral private transport. How long the combustion engine will continue to be the transitional solution depends not only on political decision-makers but also and above all on progress in the development of battery technology and on the widespread availability of charging infrastructure – the requirements are longer range at economic cost. Experts think that combustion engines will be continuing to play a role for a long time in the transition period and afterwards as well.

According to a study by FEV, one of the biggest independent development service providers in the world in the automotive field, less than one per cent of all the vehicles sold around the world in 2016 were primarily driven by electricity. The engine experts are working on the assumption that the majority of all the vehicles sold in Europe in 2030 will still have a combustion engine (75 to 85 per cent), although most of them (about 90 per cent) will be in hybridised powertrains. The global situation is not expected to be much different. Even if there is a strong increase in electrification of the powertrain, most drives will still have combustion engines in 2030 too – and the FEV experts emphasise that these combustion engines will need to operate in very varied drive topologies.

The majority of engine experts agree that drive systems will be electrified in future. Professor Hermann Rottengruber from Magdeburg University is certain: “The switch to purely electrical vehicles will be taking place via hybrid drive systems.” He expects a hybrid powertrain with a combustion engine and an electric motor to remain the optimum solution for many different applications and types of vehicle in the long term too. The motor expert issues a warning, however: “It is nevertheless time to think about how the market for vehicle drive components will be transformed in view of these changes”.

Electrification of the powertrain

The experience of driving an electric vehicle as well as the reduction in fuel consumption and CO2 emissions that are the aims of electrification begin with the comparatively simple automatic start-stop system based on 12 V electrics and end with a completely battery electric vehicle (BEV) with high-voltage technology.

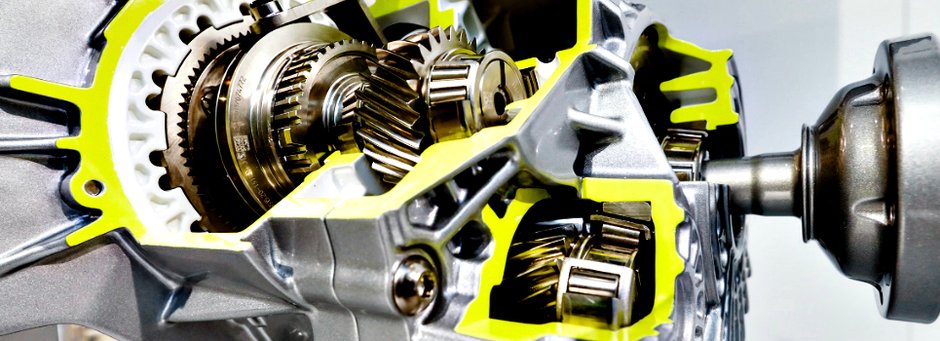

Electrification leads to a fundamental change in the powertrain. Entire supply chains for engine manufacturing need to be rethought completely. Whereas combustion engine drives are dominated by manual and automatic transmissions with up to ten gears, an exclusively electric vehicle manages without complex engines and transmissions. While the engine and transmission of a conventional car consist of about 1,400 parts, an electric motor plus transmission have no more than about 200.

The consequence for foundries of the elimination of combustion engines: no cylinder blocks, no cylinder heads, no pistons, no exhaust and other manifolds. Steel manufacturers lose forged crankshafts, camshafts and complicated transmissions. Steel mills and foundries have every reason to be relaxed about such developments all the same. Classic combustion engines and new electric motors will need to be manufactured alongside each other for many more years anyway, which will lead initially to an increase in components. While electric vehicles include forged and moulded steel parts and castings as well, so that new opportunities will be created. No battery vehicle moves without highly complex cast and steel components.

Lightweight structures the key technology

The battery, electric motor, powertrain and power electronics are the crucial components in electromobility.

The Tesla electric limousine with the longest range (600 kilometres) incorporates a battery that weighs 750 kilograms. Average electric cars have to move batteries weighing between 200 and 300 kilograms. Economic lightweight structures are becoming a key technology in automotive manufacturing, so that electromobility reaches the mass market in spite of the weight and expense of the batteries. While the electric car pioneer Tesla started initially with a blend of aluminium, titanium and steel and BMW chose expensive lightweight carbon fibre-reinforced plastic for its electric car i3, a change is now apparent thanks to new lightweight steel materials. The new Tesla Model 3 is based mainly on steel and BMW has in the meantime discontinued its joint venture with the carbon manufacturer SGL Carbon.

The need for lightweight structures and the weight reduction associated with electromobility are an encouragement to foundries. Lightweight cast components made from non-ferrous metal – aluminium and, to a lesser extent, magnesium – are becoming increasingly important as rivals to steel and aluminium sheet and profile components for chassis and body parts too. Struts and longitudinal bars made from diecast aluminium, for example.

Nemak, one of the leading lightweight metal foundries that supply automotive manufacturers, thinks that structural components made from diecast aluminium represent in general a very interesting combination of weight reduction potential, costs and component properties. The company points out that structural casting is in the meantime also being introduced in higher-volume, mid-size vehicle platforms that need to be manufactured in identical quality in several different markets all over the world at the same time.

Economic lightweight structures are dominated by a combination of high-strength steel and selected aluminium components in electric cars too. The car supplier Kirchhoff, for example, presented a concept for a crash-resistant and economic battery housing with an integrated cooling function made from a hybrid steel-aluminium structure at the International Motor Show (IAA) in 2017. Professor Christoph Wagener, Vice President Research & Product Development Kirchhoff Automotive, explains that the objective was to produce a battery housing that is as light as possible while still being inexpensive at the same time. For corrosion protection reasons, a steel underbody must have a wall thickness of at least 1.5 millimetres, which makes it comparatively heavy. The lightweight structure produced by Kirchhoff with a framework of aluminium profiles satisfies all the requirements, such as passive safety, flat design, thermal management, electromagnetic compatibility, sealing and corrosion protection. thyssenkrupp Steel also presented its concept for a battery housing at IAA. The module developed from high-strength steel is supposed to weigh no more than a comparable aluminium version, but cost only approximately half as much.

High-strength steel is the main option in the cost-sensitive volume market. Philippe Aubron, Chief Marketing Officer at the ArcelorMittal Automotive Europe Corporate Division, says: “Electric cars can be built 50 to 60 kilograms lighter with steel”. The portfolio supplied by the world’s biggest steel manufacturer includes not only flat steel but also long products for exclusively electric cars. Although the transmissions of electric cars are less complex than classic powertrains, the demands made on the components are similar. The powertrain of a BEV apparently includes, for example, drive shafts and transmission components that are manufactured from special bars and rolled wire. Competitors like Saarstahl and the Georgsmarienhütte steel group are also carrying out similar development work to the world’s largest steel manufacturer in the long steel sector.

Electrical strip a core material

Both steel and cast products continue to be essential for the engine and powertrain as the switch is made to electric cars. “Electromobility is not possible without steel”, says Andreas J. Goss, CEO of thyssenkrupp Steel. The company considers itself to be the market and technology leader for electrical strip, the core material for all electric motors. Motor torque depends to a large extent on the quality of the easily magnetised steel product. The iron-silicon alloy determines the efficiency level, which is supposed to be as high as possible, and the energy loss due to remagnetisation, which is supposed to be as low as possible. Only a few manufacturers anywhere in the world supply this expensive special material; the competitors that do so include ArcelorMittal and the Austrian company voestalpine.

Research and development work has not been completed by a long way yet. Vacuumschmelze from Hanau in Germany recently demonstrated just how much potential the electrical strip technology has. Equipped with material from this manufacturer of special materials, the world record-holding electric racing car “Grimsel” accelerated from zero to one hundred in only 1.513 seconds. No car in the world that is produced in series can get anywhere near acceleration of this kind. Not even the 1,000-horsepower “Project One” model manufactured by the Daimler subsidiary AMG. The “Hypercar” with Formula 1 technology that was presented at IAA 2017 took 2.5 seconds to reach one hundred. The four electric motors in the “Grimsel” have sheet metal packages made from a special material that would be prohibitively expensive for series production. Vacuumschmelze is thinking of launching a modified electric motor material for premium vehicles on the market even so.

Electric motor housings made from cast aluminium

Electric cars incorporate plenty of castings from foundries such as Georg Fischer (GF) or Nemak too. From 2019 onwards, for example, the GF Automotive Division based at the Mettmann location in Germany will be producing battery housings made of aluminium with an integrated cooling system for a French car manufacturer. Competitor Nemak also confirms that additional growth is being generated by the change in drive concepts and the introduction of new structural electromobility components like battery housings.

Electric drive systems for cars require a large number of new components. Not only housings for batteries but also and above all housings for electric motors and power electronics, which are designed preferably as castings due to their complexity, as Christian Heiselbetz, R&D Director Global at Nemak Europe reports.

Combustion engines made from diecast aluminium have been standard solutions for a long time now. Electromobility is creating new market opportunities for foundries. Cast motor parts are high-quality key components in both partly electrified and battery electric vehicles. Since 2013, for example, Nemak has been supplying the diecast electric motor housings for the BMW models i3 and i8. Casting technology with mature process and systems engineering for diecasting and low-pressure casting and such casting processes as lost foam, sand and investment casting is in a position to meet extremely varied challenges and take advantage of its strengths – particularly when complicated components and functional integration are needed. If complex cooling circuits are necessary, for instance, then low-pressure casting permits the use of sand cores or the inclusion of tubes in order to be able to carry out optimised cooling, as Nemak research director Heiselbetz emphasises.

Franz-Josef Wöstmann, foundry expert and departmental manager at the Fraunhofer Institute for Manufacturing Technology and Advanced Materials IFAM, thinks that there is a promising future market for foundries not only in lightweight structures and not only in housings for electric motors, batteries and power electronics. He considers rotors with aluminium or copper and even hybrids to be an issue. The foundry expert stresses that coils can be cast and new magnetic casting materials could become a market.

New drive concepts with formed steel and diecasting

The drive technology for electric vehicles in future also requires a transmission and thus highly complex diecast aluminium components as well as equally complex steel components manufactured via forming technology, as is confirmed by Astrid Wilhelm-Wagner, Marketing Manager at Voit. The automotive supplier from Saarland in Germany that has its own foundry intends to strengthen the production of conventional transmission parts (primarily for the supplier ZF) and expand the electromobility business at the same time. “The established manufacturing segment for conventional powertrains is already being substituted in the hybridisation of existing drive concepts up to and including completely integrated electric drive modules”, says Wilhelm-Wagner. Some existing components will in her opinion be eliminated entirely in future, while other components such as control units for power electronics will be integrated directly in the transmission. The product range will be extending more and more in the coming years. The Voit expert lists such components as internal transmission parts, housing structures for electromobility applications, housing structures for power electronics, electric motor housings, energy recovery components and fuel cell stacks.

Author: Gerd Krause; Mediakonzept/Düsseldorf