Germany is in recession. The aluminum industry has not been able to escape this dramatic development. On the contrary, it is suffering particularly badly from high energy costs and the weak economy. Rob van Gils, President of Aluminium Germany (AD), emphasized: "The year 2023 has shown very clearly: The energy transition strategy in its current form is not working. Overregulation, massive bureaucracy and a lack of understanding of the importance of the industry for prosperity and participation in Germany are damaging acceptance of the need for a smart climate protection policy."

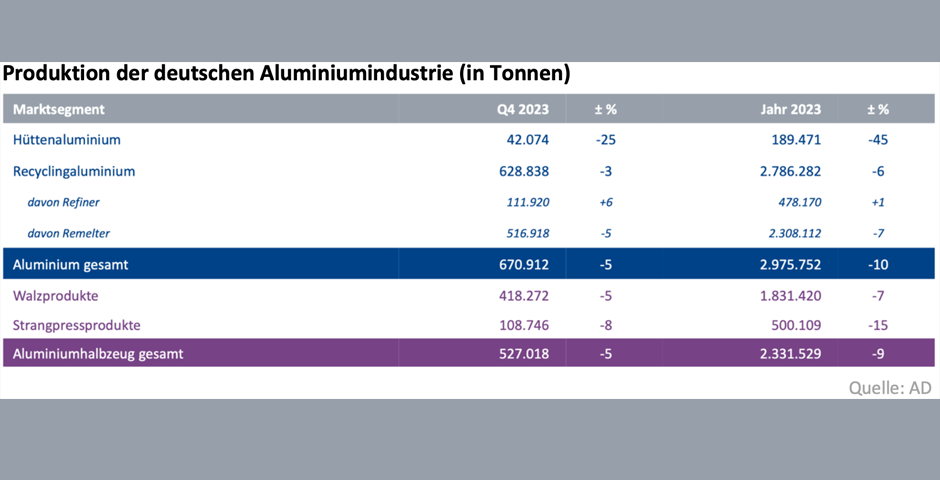

The German aluminum industry recorded significant declines in production in almost all sub-sectors in 2023. The decline was particularly pronounced in primary production. After a drop of more than 30 percent in the previous year, production in German smelters fell by a further 45 percent to 189,000 tons in 2023. They still produced just over a third (37%) of the volume before the energy crisis. Even in 2009, the year of the economic and financial crisis, significantly more primary aluminum was produced in Germany. Until 2021, Germany was the largest primary aluminum producer in the European Union. Since then, companies have been forced to take drastic measures due to the ongoing very tense situation on the German electricity market. One of the remaining four German aluminum smelters was finally shut down at the end of 2023.

Companies in the aluminium semis processing sector also suffered significant declines (-9%). At 2.33 million tons, the production volume reached its lowest level since the financial crisis. Among these, manufacturers of extruded products recorded a particularly sharp drop of -15% - they produced 500,000 tons. Production among manufacturers of rolled products also fell significantly to 1.83 million tons (-7%). While companies are struggling with the difficult local conditions, they are also facing increasing competition from importers from third countries where ecological, social, and ethical standards are significantly lower.

Rob van Gils continued: "We have emphasized several times that without aluminium, resilient supply chains and more strategic independence from third countries, the transformation of European industry will not succeed. Furthermore, there is an urgent need to put the importance of industry as a driver of employment and prosperity back at the heart of political decisions. It is not good news if CO2 emissions fall to their lowest level since the 1950s in 2023. This is not the result of a smart energy policy, but the result of a disastrous economic policy."

Outlook for 2024:

Looking ahead to the new year, AD's member companies are very concerned about Germany as an industrial location. They are asking themselves the legitimate question of whether courageous entrepreneurship, innovative strength and their contribution to economic prosperity are even politically recognized or even appreciated. Companies can certainly cope with economic cycles, but not with ever-increasing over-regulation with a moral finger pointing but without an industrial policy compass.

The President of AD comments: "Our companies have been investing in more efficient and therefore lower CO2 production for years. Both our products and our processes have the footprint as an important goal. For us and for our customers. Instead of strengthening and supporting this development with smart framework conditions, additional burdens are being added year after year, month after month. This cannot and will not go on for long. The stock market adage also applies here: the jobs are not gone; they are just somewhere else."