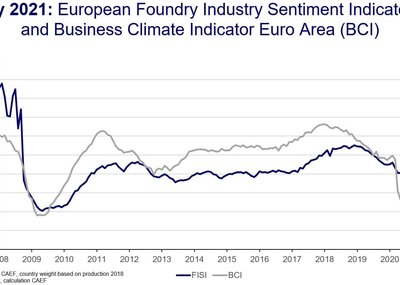

Foundries are an important player of the European value chain and home to many qualified workers in rural areas. 70 percent of the approx. 4 700 foundries with 300 000 employees operating in EU are considered small- and medium-sized enterprises (SME), operating mainly in regions, already having suffered from industrial decline in recent years. Their survival is of utmost importance for regional development and prosperity.

Nowadays high raw material and energy prices are a burden which many of these SMEs are no longer able to carry under consideration that the average profit margin in “normal times” lies only somewhere between 2-3 percent.

We as European Foundry Association (CAEF) must explicitly underline our concerns and therefore indicate that the current situation composes a vital treat to many of our member foundries. Never in post-second World war history, we had to face such an increase of prices across virtually all relevant input factors or that some materials are not even available regardless of their price. In particular, the following components go “beyond the ceiling”:

1. Base materials: e.g. Ferrous and non-ferrous metals

2. Alloy elements: e.g. magnesium, silicium, copper, nickel

3. Chemicals and other oil derivates: e.g. sand, resin, binders

4. Energy: e.g. gas, coke, electricity, oil

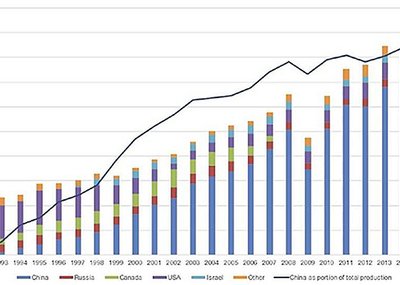

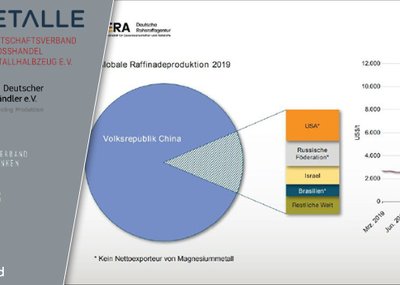

Just to exemplify: the European economy might run out of magnesium end of this year, if imports from China remain restrained. Most factories are currently shutdown due to environmental issues and energy constraints. Europe has stopped its own magnesium production in 2001 in the aftermath of Chinese dumping. This dependency comes at a high price! Magnesium is needed as critical alloying element for aluminium and nodular cast iron.

In conjunction with the Russian decision not to book transport capacities for gas through the Ukrainian pipe to Europe, a cold and devastating winter lies ahead of us. Germany alone depends more than 50 percent of its gas consumption on Russian imports. Moreover, natural gas is playing a crucial role in helping the European transition to low-carbon energy production and its lack would slow down this process significantly.

These are only the most recent updates in a year full of alarming signals from the raw material and energy sector.

Foundries operate with often 80-90 percent metal scrap and are therefore regarded as upcycles as well as pioneers of circular economy. Despite strong efforts to curb energy consumption and carbon emissions, most of the energy is needed in the furnace and heat treatment to produce components such as medical devices, pipes, pumps or wind turbines. European foundries therefore support the shift towards renewable energy production but are dependent on reliable raw material and prices and available energy at competitive costs. Otherwise, we will lose our European facilities within the next years.

If the European industrial transformation and its related ambitions towards climate neutrality does not imply to transfer casting components to locations in low-cost countries with low environmental and social standards, authorities should take immediate actions.