See here the statement and demands of WV Metalle (Wirtschaftsvereinigung Metalle, Germany):

A situation similar to the chip crisis is feared.

- It is expected that the current magnesium reserves in Germany, and in Europe as a whole, will be exhausted in a few weeks at the end of November 2021 at the latest.

- A supply bottleneck of this magnitude would therefore threaten massive production losses.

- The entire aluminium value chain is affected, with sectors such as the automotive, aircraft, electric bicycle, construction or packaging industries as well as mechanical engineering. Other magnesium-processing sectors include die casting and iron and steel production.

1. Market overview and affectedness in Germany

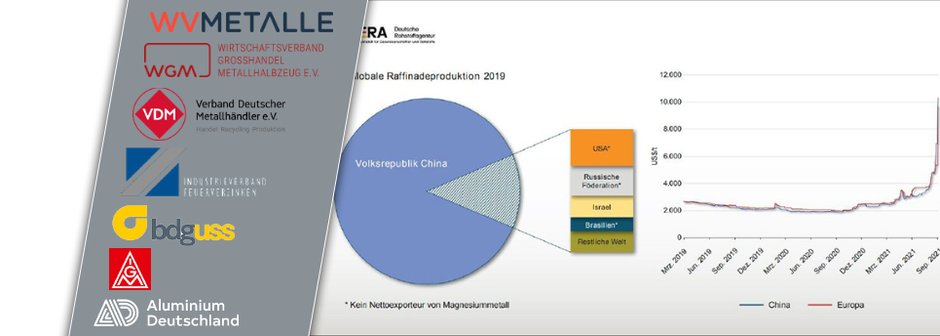

With an 87 percent share of production, China has an almost complete monopoly on global magnesium production. About 45 percent of all Chinese exports are destined for Europe. Germany and Europe are also particularly affected by the supply bottlenecks because in 2001 the remaining magnesium production was abandoned for various reasons. As a result, Chinese exports now cover 95 per cent of Europe's magnesium demand, creating an almost complete dependency.

Magnesium has been on the EU's list of critical raw materials since 2017. The European Commission made this clear in its Communication on "EU Critical Commodity Resilience: Charting a path towards greater security and sustainability" in September 2020. However, political-strategic considerations and measures to secure the flow of supplies have so far failed to materialize.

The severe shortage of magnesium is already leading to record prices, creating global market distortions and heralding huge disruptions in the supply chain. We also refer to the corresponding chart of the month September of the German Commodity Agency DERA.

2. Background

A few days ago, the Development and Reform Commission (DRC) of Yulin City published a new document on achieving energy intensity and consumption reduction targets by 2021. The document stipulates that major energy-intensive industries or enterprises should reduce or stop their production accordingly from September to December.

Due to the current energy shortage in China, this also affects other energy-intensive industries or companies, but magnesium production is particularly affected. Based on various sources, it can be assumed that so far at least 31 magnesium plants in the world's most important magnesium production centres, Shaanxi and Shanxi provinces, have either been shut down or had to reduce their production by 50 per cent.

The current magnesium shortage is a clear example of Germany's dependence on Chinese imports and the associated risks.

Demands of WV Metalle

In the short term: Urgent initiation of diplomatic talks with China in order to be able to guarantee the continuation of production in Germany.

Long-term: Germany needs an industrial policy strategy for secure access to industrial metals. Together with the EU, effective medium- and long-term measures must be taken to maintain functioning and sustainable value chains.

On our own behalf, from the perspective of the global media companion (Foundry-Planet)

As a media companion in a global industry like the foundry industry, which has functioned excellently for a long time, it is not only a matter of fairness but also of consensus and understanding that all market participants only have a chance in the long term if we regard the trust we have built up as the yardstick for our actions. This is especially true in already difficult times. Now we will see how resilient the supply chains really are and what contracts and agreements are worth. Up to now, the parties involved have usually benefited equally and this should be remembered very quickly. Globalisation has already changed during the Corona pandemic. A magnesium/aluminium shortage could cause immense damage and will ultimately lead to dislocation and the loss of the trust that has been built up.

Seriously, no one can really want that. Before trust is gambled away, it is time for diplomacy, and that applies to the whole of Europe and overseas partners.