A pillar of the EU economy, the auto industry, is starting to shake

Investment and trade data suggest that the EU's automotive industry may be losing its competitive edge

What you will find in this edition

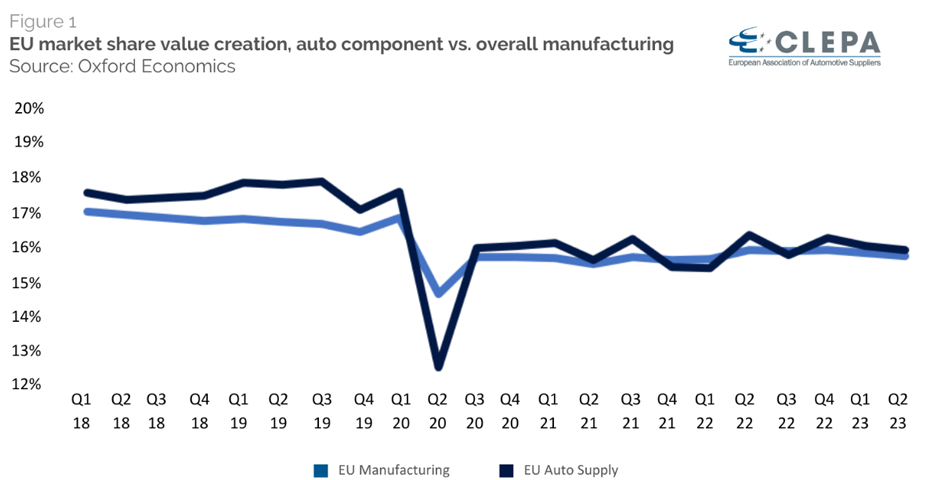

1 - EU auto suppliers maintain slight edge in market share amidst stagnation

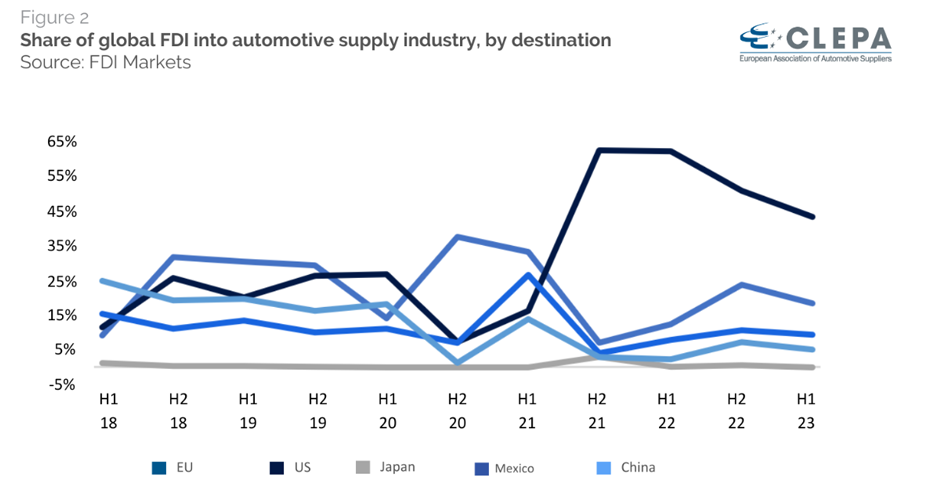

2 - US continues to outperform the EU as an investment destination

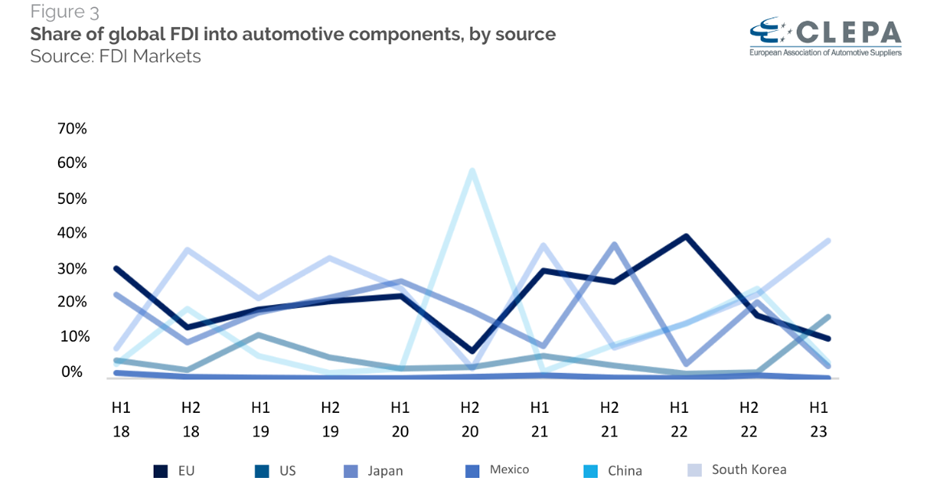

3 - EU suppliers face FDI decline and new challengers

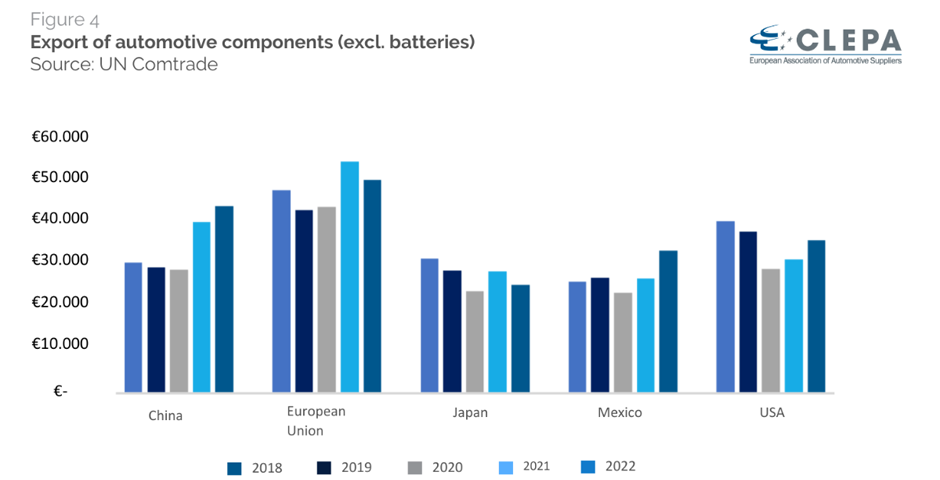

4 - EU’s export dominance of conventional components seeing growing pressure

5 - Battery imports dent EU’s trade surplus

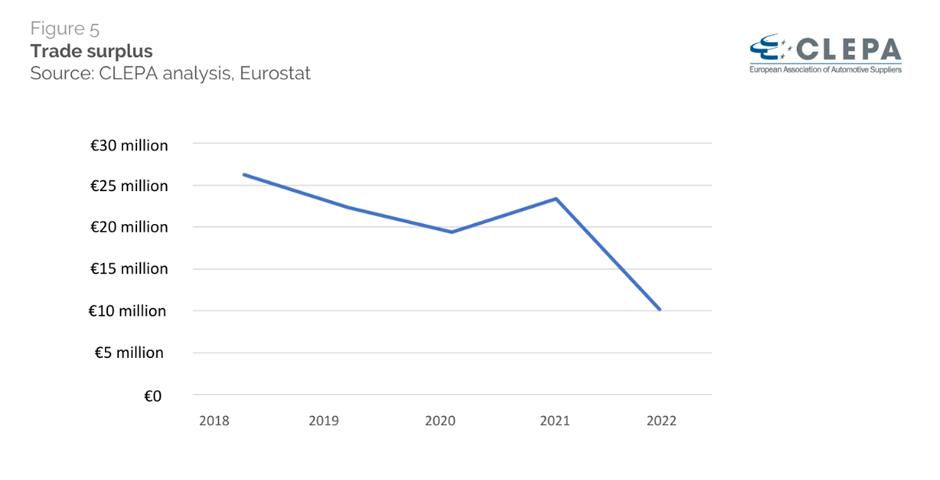

As the EU grappled with a staggering trade deficit of €440 billion in 2022, Europe’s automotive industry generated a trade surplus of more than €110 billion. Defying the odds, this industry remains a vital pillar of the EU economy, contributing €25 billion to this surplus. However, subtle tremors are becoming evident. The industry’s robustness is being threatened by the mounting challenges that undermine its competitive standing. Despite ambitious investments in the battery supply chain, the import of batteries has chipped away at the once-strong trade surplus for auto components, eroding more than 60% since 2018.

Across the span of 18 months, the US has witnessed a remarkable surge, attracting almost three times the investment the EU has managed to secure within the auto supply and battery sector. And perhaps most concerning, auto suppliers find themselves at a crossroads, beginning to relinquish their market share concerning foreign direct investment. It’s a picture of resilience, combined with vulnerabilities, urging the industry to navigate a shifting landscape in order to safeguard its pivotal role within the European economy.

"EU suppliers built a global lead in the previous decade, resulting in an annual trade surplus close to €30 billion. If the current growth of battery imports continues, in 2024, the EU could become a net importer of automotive components." Nils Poel - CLEPA's Deputy Head of Market Affairs

1 - EU automotive suppliers maintain slight edge in market share amidst stagnation

Amid a period of stagnation, the EU’s automotive suppliers continue to hold a slightly higher global market share (15.9%) compared to the broader manufacturing sector (15.7%). However, both sectors remain below pre-COVID levels.

2 - US continues to outperform the EU as an automotive investment destination

Foreign direct investment (FDI) continues to flow into the EU’s automotive supply chain, albeit with a significant gap compared to the US. Over the last 18 months, non-EU companies invested over €14.3 billion into the EU, while the US attracted a staggering €42.8 billion during the same period. Further, the US is surging ahead in battery production capacity, leaving important question marks on EU industrial policy.

3 - EU suppliers face FDI decline and new challengers

Although EU-based automotive suppliers recorded investments of €16.4 billion outside the EU in 2022 and the first half of 2023, their share of global FDI has dwindled from 43% in the first half of 2022 to just 12% over the same period in 2023. South Korean companies like Samsung, LG, and Hyundai are increasingly posing a challenge to the EU’s FDI dominance, investing €17.5 billion in the US battery supply chain. Meanwhile, US suppliers surpassed EU suppliers in terms of investment for the first time since 2018.

“Automotive suppliers continue to outperform, but the EU is losing ground. Policymakers have established a framework towards 2030 with ambitious environmental and societal goals, requiring swift and strategic responses to maintain competitiveness in a rapidly evolving landscape." Benjamin Krieger - CLEPA's Secretary General

4 - EU’s export dominance of conventional components seeing growing pressure

In 2022, the EU’s automotive supply industry achieved an export total of €51.7 billion, maintaining its global lead. However, this dominance is gradually eroding with China’s exports growing by 9% during 2022, while the EU recorded an 8% decline. As the gap narrows, it could be that this year or the next marks the year that China takes over. This unfolding trend underscores the EU’s stagnation amid its competitors’ growth.

5 - Battery imports dent EU’s trade surplus

The EU's automotive components trade surplus dipped by 11% in 2022 and plummeted by 56% when including battery trade. Li-ion batteries surged threefold in terms of total trade value in 2022 compared to the previous year. Although investments in the EU battery supply chain should eventually mitigate imports, the import value of batteries in Q1 2023 have almost doubled compared to the same period in 2022. Simultaneously, sales of battery electric vehicles grew by over 53.8% across the EU in H1 2023.