Only a few formal steps remain for the EU to finalise the decision on the path to climate neutrality for cars and vans. With a 100% target in 2035, electrification of the drivetrain is the main way forward, either with a battery or a fuel cell to propel the vehicles.

This is as much a challenge for the industry as for policymakers. For electrification to take off as expected, framework conditions need to be put in place, for recharging, refuelling, for hydrogen production and green electricity. For the existing fleet, only with CO2-neutral fuels can we defossile the car parc. The debate on the related policy files needs to be finalised as swiftly as possible.

This is even more urgent for trucks. A proposal for CO2 standards is expected at the beginning of next year. The diversity of use cases for commercial vehicles requires a wide array of clean solutions. From electrification and hybrids to hydrogen in fuel cells and engines, to eTrailers, options are needed to meet specific needs, while lowering emissions and remaining affordable. Total cost of ownership is the decisive criterion for new technologies to succeed. Both regulations on CO2 standards must be in sync with other dossiers, notably Euro 7, which will be discussed in the coming months.

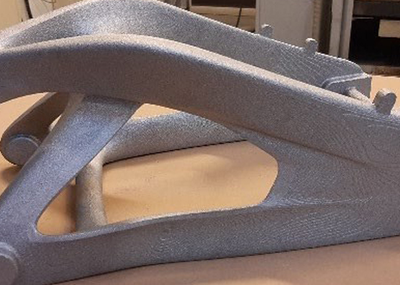

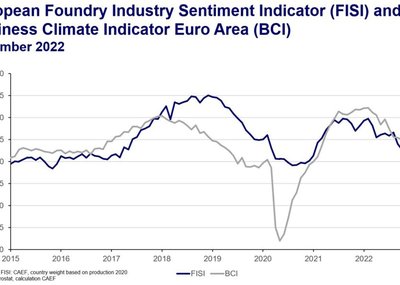

The automotive supply industry is delivering the technology for the transition to climate neutral mobility. But the industry needs support, as does the entire ecosystem. As shown in our Fall 2022 Pulse Check survey and November Data Digest, our industry is currently investing heavily in the full development of sustainable mobility, despite current inflation and rising costs that in many cases are reducing profitability margins.

I was able to raise these concerns at a recent roundtable event organised by DG GROW on the ‘Transition Pathway for the Mobility Ecosystem’. It is good to see the Commission take the initiative to discuss these challenges with industry, but concrete political support is needed, particularly with regards to funding a just transition for the automotive sector.

Today, CLEPA’s President Thorsten Muschal, will on invitation by Commissioner Breton discuss potential bottlenecks and key performance indicators to make the transition to climate neutral mobility a success. Swift deployment of infrastructure for electricity and hydrogen is a key criterion, but the impact on the industry and jobs, the capacity to transform and to innovate, and the affordability of mobility also need to play a central role.

EU in global competition

The effort of suppliers is critical in the success of the mobility transition. Investments in innovation are needed to mitigate the impact of a sustainable supply chain on consumer prices.

This is why we believe that the EU Sustainable Finance Taxonomy should recognise the role played by automotive suppliers. In the current delegated act, EV component production is not eligible as sustainable investment, as is the case for vehicle assembly. Key R&D and manufacturing activities of technologies related to EVs may find it harder to be recognised as sustainable investments, where activities related to the assembly of the vehicles are. This could reduce the required funding towards critical innovation, and puts at risk the success of the transition. CLEPA will be launching a #FairTaxonomy campaign to raise public awareness on the issue, which was recently covered by Politico.

Further, targeted measures to maintain European industrial competitiveness are crucial. Increased competition from and sourcing dependence on China have been on the radar of industrial strategists for a while. More recently, concerns about fair competition from the US have gained ground in our industry.

The Inflation Reduction Act (IRA) introduces significant subsidies for the production of batteries in the US and introduces consumer subsidies for electric vehicles produced in North America. The EU has seen strong investments in the development of a battery supply chain over the past years, but several companies have recently indicated a shift in investment projects from Europe to the US. The high energy costs in the EU and more generous subsidy schemes in other countries presents a significant risk for the competitiveness of EU industry.

A subsides race should be avoided. Goldman Sachs calculated at €160 bn, the investment needed between the US and Europe together to reduce the singular dependency on Chinese battery materials and cells by 2030, highlighting the need for collaboration. CLEPA appreciates the significant efforts from the European Commission to better align green industrial policies on both sides in this regard.

To secure and diversify supply of critical raw materials, the European Commission is currently working on the Critical Raw Materials Act proposal expected in January. In the meantime, the EU Chips Act passed an important legislative milestone. Member States agreed their position on the Commission proposal, bringing the regulation close to adoption next year and paving the way for billions of public support for projects in the EU semiconductor ecosystem. This is a step forward towards a more comprehensive EU industrial policy, and the automotive ecosystem must be part of the strategy given its role as one of Europe’s key industrial sectors.

The green transition will only succeed by laying a solid foundation to sustain European competitiveness next year and beyond.