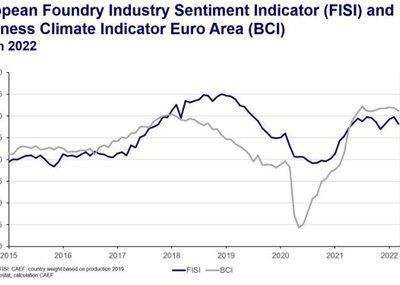

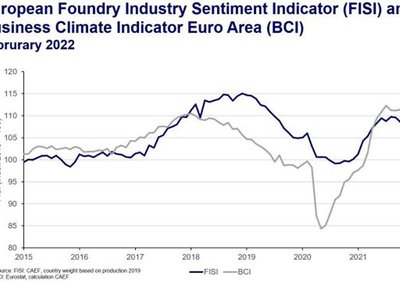

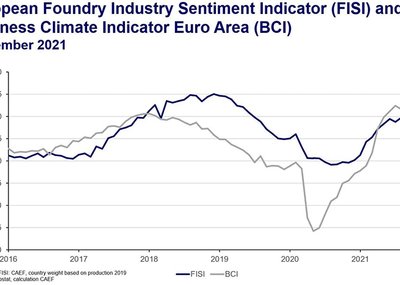

After recent signs of a comprehensive slowdown, steel, iron and non-ferrous metal foundries assessed the current situation in December as significantly better than in the previous month. Expectations for the upcoming six months do not, however, take this selective assessment into

account. The European Foundry Sentiment Indicator (FISI) nevertheless improved by 1.1 points to the new index value of 108.1. Exploding infection figures in Europe and on the globe are a cause of concern for the industry again. In addition to the direct impact on the production facilities, further disruptions in the global supply chains and associated cost increases and availability problems for primary materials are to be expected. While this also offers European foundries great business opportunities, as the demand for castings is sufficient especially in mechanical engineering, the enormous energy costs continue to burden the entire industry. Although the urgency of the situation has been recognised by politicians, quick and effective solutions are difficult to find due to geopolitical tensions and international dependencies on energy markets.

At the same time, the Business Climate Indicator (BCI) remains on a high level in December. The slight increase of 0.05 points brings the index to 1.84 points. Main drivers are the production trend of the last weeks and the employment expectations.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

Please find the chart enclosed or combined with additional information at www.caef.eu.