Aluminum and aluminum alloys are considered the most interesting materials for the next phase of AM growth into large batch and serial production applications. This is due primarily to aluminum’s excellent mechanical properties and low price when compared to similarly lightweight metals such as titanium. However, this vision, while in progress, is still far from realization due to several inherent challenges in aluminum 3D printing, and producing aluminum parts by AM processes.

At the same time, significant fluctuations in aluminum prices, output and availability have plagued the supply chains in recent months, especially as global tensions have grown as a result of the Russia-Ukrain conflict. for multiple reasons. The first is that Russia is a major supplier of aluminum to global markets and RUSAL, Russia’s largest manufacturer, supplies 40% of the European Union’s aluminum requirements. The second is that aluminum smelting is a power-hungry process and as such, it has been affected by the recent energy crunch. AM could provide a solution for supply chain resiliency in some cases by reducing the amount of material needed to produce certain additively manufactured parts.

Materials and technologies for aluminum 3D printing

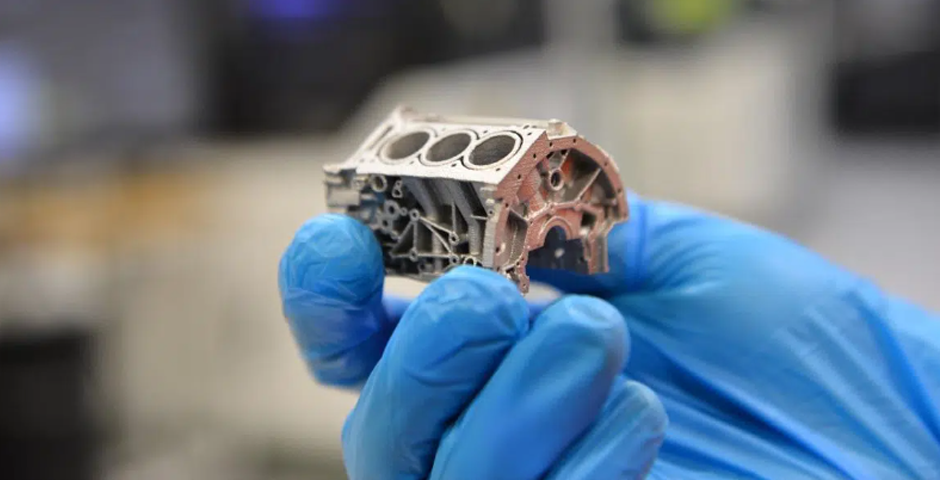

One early challenge in aluminum 3D printing was that almost all aluminum alloys used in AM were originally developed for casting applications. In fact, the most common aluminum alloy used in AM by far is AlSi10Mg, an age-hardening aluminum alloy with good hardness, strength and dynamic toughness, which is traditionally used as a casting alloy. Powder made from AlSi10Mg is commonly used in additive manufacturing due to the high corrosion resistance, low density and high mechanical strength of the final components.

Common aluminum alloys available commercially for AM and relative technologies

Aluminum for L-PBF

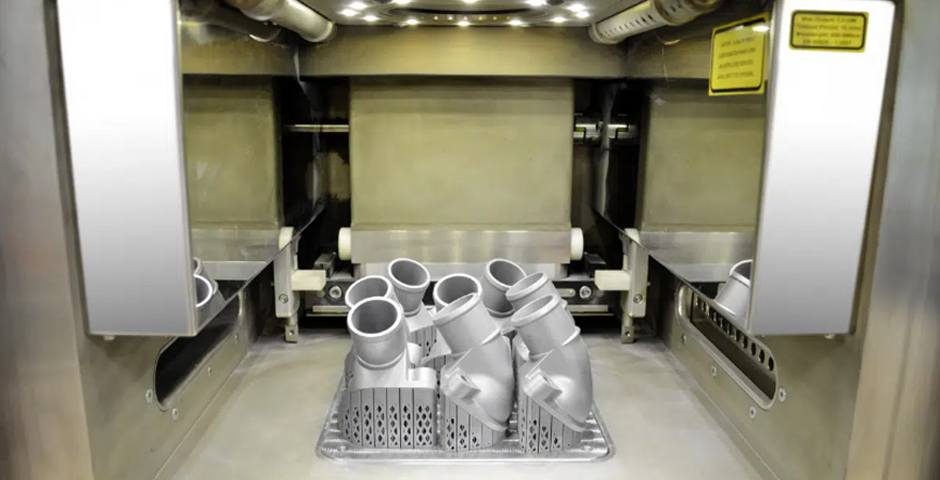

One approach that hardware companies and service providers took was to develop AM processes (mainly L-PBF) that can proficiently use these relatively common aluminum alloys. For example, US company Velo3D developed a process for 3D printing parts made from aluminum F357 using its Sapphire system. This created new opportunities for the foundry-grade aluminum alloy, especially for thin-walled heat transfer applications in the aerospace and defense industries. Aluminum F357 is considered ideal because of its ability to be anodized and its similarities to the popular casting alloy A357. Around the same time, as part of a collaborative effort between Honeywell and SLM Solutions, newly developed parameter sets for aluminum alloy F357, a new beryllium-free version of AlSi7Mg0,6 (A357), have led to considerably improved material properties compared to parts produced through die-casting. The work between Honeywell and SLM Solutions, announced in 2019, was based on metal powder bed fusion 3D printing with high layer thickness and it was aimed at a reduction of manufacturing times and costs for the production of 3D printed aircraft components that meet the requirements of the aerospace industry.

Another relatively new company, Uniformity Labs, has been developing specific know-how on metal powders for AM (and working closely with Desktop Metal on aluminum binder jetting, as you’ll see further down). The company also offers the UniFuse AlSi10Mg Aluminum powder range and just released optimized parameters for L-PBF printing at 50um and 90um layer thickness. This follows the previous release of UniFuse AlSi10Mg and optimized parameters for 30um layer thickness printing