Founded in 1979, A-Kaiser GmbH specialized in the processing of lightweight aluminum components and ultra-light magnesium parts for automobile manufacturers and Tier 1 suppliers of body components and parts for electromobility.

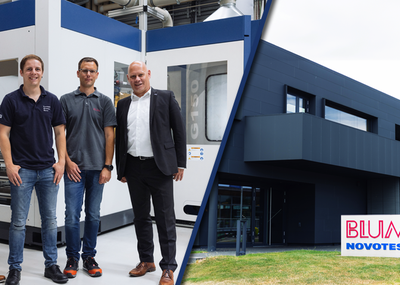

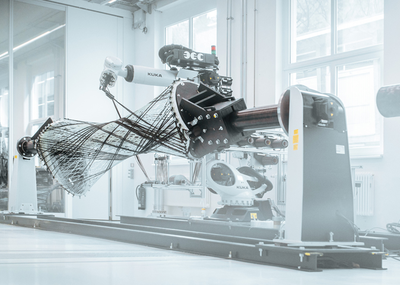

More than 2,500 items of tangible assets are offered through auctions and private sales. Assets include multi-axis machining centers, multi-spindle automatic lathes, grinding machines, washing lines from global brands such as Grob, Mori Seiki, Okuma and Brother with associated tooling, proof test equipment, robotic automation from Kuka and ABB, and factory equipment and utilities.

For more information and a detailed inventory of assets, including images of available equipment components, see: https://uk-assets.gordonbrothers.com/akaiser

"We are delighted to offer this wide range of specialist equipment in excellent condition," said Duncan Ainscough, General Manager, Commercial & Industrial at Gordon Brothers. “This sale is one of the largest machine tool divestitures in recent years and we anticipate significant global interest.”

"This partnership is our second major divestiture in the German automotive sector with Gordon Brothers, following the liquidation sale of JD Norman in 2021," said Daniel Kröger, Managing Director at Maynards Europe. "The firm builds on its decades of experience buying, selling and valuing assets and we are proud to continue our partnership."

For further information on the sale or to view the assets by appointment, please contact Mr. Duncan Ainscough at dainscough@gordonbrothers.com or Mr. Sebastian Geissler at sebastian@maynards.com.

For all press inquiries please contact: GBcomms@bwpgroup.com.

About Gordon Brothers

Founded in 1903, Gordon Brothers (www.gordonbrothers.com) helps lenders, operational leaders, advisors and investors manage transformation in times of change. Gordon Brothers offers clients a strong combination of relevant expertise and capital to develop customized approaches across four areas of its service offering: Valuations, Divestments, Transactions and Investments. Gordon Brothers partners with retail, commercial and industrial companies to help them make the best and most profitable use of their assets to drive growth or implement operational improvements. Gordon Brothers completes over $70 billion in sales and appraisals annually and is headquartered in Boston with more than 30 offices on five continents.

About Maynards

Established in 1902, Maynards specializes in auctions, liquidation sales and the valuation of commercial and retail manufacturing facilities and inventory. With offices in the United States, Canada, Germany, United Kingdom, China and Japan, we are constantly conducting sales and appraisals of assets in a variety of industries around the world.

Maynards has the expertise and resources to execute simultaneous equipment sales and asset liquidations in all heavy industry sectors including automotive manufacturing, plastics, semiconductors, pharmaceuticals, energy, food manufacturing, metalworking, pulp and paper, the sawmill industry, mining, printing and wood processing. www.maynards.com