Cornel, do you drive an electric car and what is your experience with it?

Cornel : Yes, I’ve been driving an electric car for over four years, and I would not go back. You have to think ahead about charging your car and the distance you’re driving. But when we are on vacation with the family, we more frequently stop for a break for us than to recharge the battery.

Which of these developments is already reality, which ones are happening faster than we thought, and which are taking a bit longer?

Cornel : The trend towards e-mobility is happening a lot faster than we expected. A while ago, we carried out an analysis with a base, intermediate, and an optimistic scenario. The current development is moving faster than even our most optimistic scenario. The shift towards e-mobility is now visible everywhere. Look at Tesla and the many Chinese new energy vehicle companies.

However, it is also clear that we will continue to live with all kinds of drivetrains for the next few decades – full electric, hybrid, fuel cell, and combustion engines. In terms of the other trends, connectivity is developing fast so that we now see the car of the future as a computer on wheels. In terms of sharing and autonomous driving, these developments will take longer to become mainstream, but there is no doubt that they will happen too.

Marcel, you have been in charge of Bühler’s Advanced Materials business since March 1 this year. How is it going?

Marcel : I am very excited, and also very grateful. I am taking over this fascinating business at a moment in which the markets are in a fundamental transformation. The key words of this new era of mobility are ‘connectivity’, ‘autonomous’, ‘sharing’, and ‘electrification’. This opens up new opportunities for all market players, including Bühler. We have put a lot of focus on strategically developing innovations in recent years and we can now offer key technologies and solutions in this area – just as these trends are developing into reality.

What does that mean for the original equipment manufacturers? What are the challenges and opportunities they face in this transition?

Marcel : Let’s start with the opportunities. We are in a phase in which mobility, with the car as a key element of this, is being newly defined. With the expertise the original equipment manufacturers (OEMs) have gained over the past 100 years, they can now develop new car concepts that enable new driving and safety experiences using new manufacturing methods and utilizing new or different supply chains. They can also develop solutions that are far more environmentally friendly and more comfortable. They can offer services to their customers. They can also produce more efficiently. And they can promote their offerings through different selling approaches, such as online, which improve the customer experience.

This suggests there are also challenges, right?

Marcel : Absolutely. A key challenge is the speed of change. Can you change fast enough to keep pace with this new world, not only with new products and manufacturing technologies but, even more importantly, with your image? A large network of dealers, for instance – which has been a key element in promoting cars in the market to date – is no longer enough to reach the right target group.

New entrants are thinking differently and moving fast in this area. This is also true when we look at new car concepts. Software and connectivity are key, so more resources, knowledge, and competence are needed in this field. And there are other challenges that concern the whole industry. Legislation and government regulation have a major influence on the planning and development of mobility. This varies from country to country and region to region. Take, for example, the assumption or requirement that electric cars must make a major contribution to the transition towards sustainable mobility. This will require even more capability to develop CO2-neutral cars and solutions.

What effect will this have on the competition among carmakers?

Cornel : The cards will be completely reshuffled. That is the reason why we see so many new companies and brands, especially in China and the US.

We are in a start-up phase. This situation offers most opportunities for Chinese manufactures because they operate in the largest market, with a digital-savvy population, and they have full government support and no heritage. US carmakers have the best access to software, which gives them some advantages. The European car industry, specifically the German OEMs and their key suppliers, are in a more challenging position.

The key words of this new era of mobility are ‘connectivity’, ‘autonomous’, ‘sharing’, and ‘electrification’. These open up new opportunities for all market players, including Bühler.

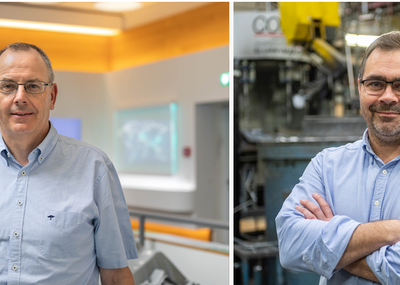

MARCEL NATTERER, CEO ADVANCED MATERIALS AT BÜHLER

We have talked about opportunities arising from new production methods. What about die casting? What role does it play in this industrial metamorphosis?

Cornel : Cars are mainly made from steel, plastic, or aluminum. All raw materials have their own specific profile, with pros and cons. However, only aluminum offers the possibility to produce large parts in one shot with such a level of functional integration and stiffness for the car body. This is the reason why we have seen a general trend over recent decades towards structural aluminum parts such as shock towers and longitudinal members. Now, with the change to electric drive trains, carmakers need to rethink the car body anyway and have the option of massively simplifying the way it is made.

In what way?

Cornel : The idea is to produce the whole car structure basically with three parts: two for the front and rear, and one middle part to hold the battery, all made of very large aluminum parts that are produced in one shot. The parts each weigh easily more than 100 kilograms.

How does this work?

Cornel : This requires a new die-casting solution, which we call megacasting. Essentially, we have developed a new class of machines – the Carat 610, 840, and 920. The last of these has a locking force of up to 92,000 kilonewtons, a power strong enough to lift the Eiffel Tower. But megacasting only works if you rethink the flow of a cell. To give you an example: the amount of aluminum required is so high that each cell needs the capacity of a current melting furnace. In addition, the part handling equipment and the presses need to be designed to carry and process such heavy parts.

What are the benefits for OEMs?

Cornel : One megacasted aluminum part can replace up to 100 smaller steel parts. Imagine what that means in terms of footprint and assembly in the factory. A rough estimate is that this saves around 30 percent of space and several hundred robots.

Also consider the engineering efforts that can be minimized. It’s hard to put all this into specific numbers, but it is obvious that it goes into the millions.

Which of the OEMs has already jumped on the bandwagon?

Cornel : Around 10 OEMs so far have decided to include megacasting in at least one future platform. These include Tesla, which started several years ago, new Chinese car manufacturers like NIO, Human Horizon, and X-Peng, as well as Volvo and various others.

What are the challenges of megacasting?

Cornel : The main challenges, among others, are the new dimension of the parts and integration of the casting into the car assembly line. Manufacturers want to ensure that they have 100 percent quality parts and no rejections. The requirements for full transparency and control of the process are higher than ever today.

Are these challenges specific to this industry?

Marcel : On the contrary. This is true for many industries and solutions. The key to overcoming these challenges is to have the data and digital connections and applications − meaning sensors, data points, cloud platforms, analytics, and monitoring − in place that allow for full process control and traceability. Bühler has made huge investments in this area over recent years and can now offer a broad range of services. We have developed our own industry platform called Bühler Insights.

What does that offer customers?

Marcel : This enables us to offer innovative services, such as MyBühler, which includes many features such as e-services, e-maintenance, and e-training, real-time remote guidance and support, web-based automation interfaces, dashboards with downtime analysis, and an online spare parts catalogue with all the related commercial functions included − and much more for a comprehensive customer experience. Today, all Bühler solutions are connected to Bühler Insights. The key solution for die casting in this field is our integrated Digital Cell, with the SmartCMS (Smart Cell Management System). It helps our customers to achieve their efficiency and sustainability targets.

How exactly does that work?

Cornel: The Digital Cell brings all of the individual die-casting components together under one smart digital brain called SmartCMS. With the capability to collect and manage information from all integrated peripherals, SmartCMS will drive a step change in the process. The Digital Cell aims to deliver zero percent scrap, 40 percent less cycle time, and 24/7 uptime. Megacasting makes this concept even more relevant.

How far has Bühler Die Casting come in realizing this concept?

Cornel : Currently, we have two fully integrated cells in operation − one in our test facility and, for almost a year now, one cell at a customer for commercial production.

The trend towards e-mobility is happening a lot faster than we expected. It is also clear that we will continue to live with all kinds of drivetrains for the next few decades.

CORNEL MENDLER, MANAGING DIRECTOR DIE CASTING AT BÜHLER

We are entering a phase where many visions for mobility and the car industry are becoming reality. Die casting aside, what other solutions can Bühler bring to the table?

Marcel : Mobility and automotive are key markets for the whole of Bühler’s Advanced Materials business. Leybold Optics, which is specialized in high precision coatings, has solutions to produce all the sensors and lenses needed for autonomous, safe, and comfortable driving. The information that these sensors gather is also crucial for connected mobility systems. Another application of this core competence is the coating of car glass to improve the climate within the car. Coated car glass can help to significantly reduce the consumption of energy needed for heating and cooling – and for electric cars, for instance, that means achieving longer distances on one charge.

Last but not least, our Grinding & Dispersing business has developed a continuous process to produce electrode battery slurry – a key component for batteries – at higher quality, with lower energy consumption, and with a smaller footprint.

This is a fundamental transition. What other opportunities does it offer?

Marcel : New services will be developed for every area of the transformation, especially around digital – for instance, in-line and instant quality control. New materials will also create new markets. Today at Bühler, we are already offering grinding and dispersing solutions that enhance the portfolio of our customers who require precursors and active materials for batteries by providing higher performance and longer lifespan.

Advanced infotainment systems, safety, and autonomous driving features, such as LiDAR, will continue to drive the demand for improved sensors and higher precision optics. And besides the transformation of mobility, changes in the way we consume raw materials, including re-use, recycling, and processing of secondary materials, are increasingly interesting for us and will create future opportunities in our Advanced Materials business, and for our customers.

In times of disruptive change there is often an element of hype. So, how sustainable are these trends really?

Cornel : The new factories currently under construction will produce the first vehicles in about three to five years. During that time, we see growing demand for new parts and perhaps also new platforms.

What is the biggest risk?

Marcel : In my judgement, the trends we have just discussed are irreversible. So, I think the biggest risk for everybody involved, be it OEM, supplier, or solution provider, is to just wait and see.

And Marcel, are you considering changing to an electric car?

Marcel : I am actually checking that out at the moment. Most likely it will be a phased approach and I will start with a hybrid.